Housing in Slovakia remains significantly less affordable than in the past, according to the country’s central bank, even as mortgage interest rates begin to ease. The era of cheap home loans is over, and for many, buying a flat or house has become increasingly difficult.

The housing crunch began in earnest in 2022 when the European Central Bank raised interest rates in response to soaring inflation, sending rates in Slovakia from around 1 percent to nearly 5 percent. While new loan rates have since fallen below 4 percent thanks to growing household incomes, the cost of real estate is once again rising – up 12 percent year-on-year in April, the National Bank of Slovakia (NBS) reports.

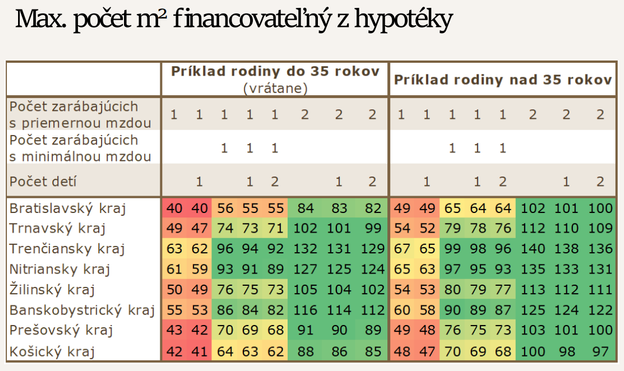

“The financial burden of buying a flat has slightly improved but remains significantly worse than the long-term average,” the NBS said, as quoted by Denník N. Compared with pre-crisis norms, Slovaks today can afford homes that are 14 percent smaller, based on current income-to-loan ratios.

Two incomes, two very different housing realities

While the NBS insists that families with two average incomes can still buy a home in any Slovak region, the picture is much bleaker for single earners and low-income households. These groups struggle to save, and the smaller, cheaper flats they can afford are often unavailable or no longer meet minimum housing standards.

Still, dual-income families can afford above-average flats throughout Slovakia, including young couples and those over 35 – the latter now making up the bulk of buyers. Even in the pricey Bratislava Region, a two-income household can secure a mortgage for a flat of more than 80 square metres.

The most favourable conditions are found in the Trenčín Region, where two earners can finance flats of over 130 square metres. There, even single people or lone parents can afford a decent 62-square-metre home. But in Bratislava, that same family could only stretch to 40 square metres – a size where housing supply is limited. Young people in and around the capital face the toughest conditions, with those in eastern Slovakia’s Košice and Prešov Regions not far behind.

Second-home buyers drive up prices

Since the summer of 2023, banks have been cutting interest rates, fuelling a renewed appetite for mortgages. Property prices, which had cooled, are now climbing again, with the first quarter of 2025 seeing the fastest growth since 2022. In April, banks issued more mortgages than in any month since September 2023.

It’s not just the number of loans that’s rising – the average mortgage amount is growing too, affecting both younger and older applicants. Crucially, more than half of new borrowers are not first-time buyers. Among those aged 35 to 50, a full 70 percent already have or have had a mortgage, according to the NBS.

“These are often second-home buyers making investment purchases,” said Marek Ličák, head of financial stability at the NBS. Their increased activity drives demand and raises prices, worsening affordability for those trying to buy their first home.

This shift in buyer demographics is likely to continue as Slovakia’s population ages. Fewer young people will be entering the housing market, which the central bank says will reduce natural demand for mortgages. Over the next decade, the number of newly issued loans is expected to fall by roughly 25 percent compared with 2019–2021 levels.

A foggy morning in Poprad, eastern Slovakia. (source: TASR - Adriána Hudecová)

A foggy morning in Poprad, eastern Slovakia. (source: TASR - Adriána Hudecová)

Maximum floor area affordable with a mortgage: examples for families under (do) and over (nad) the age of 35. Translated rows: počet zarábajúcich s priemernou mzdou – number of earners with an average wage, počet zarábajúcich s minimálnou mzdou – number of earners with a minimum wage, počet detí – number of children. (source: NBS)

Maximum floor area affordable with a mortgage: examples for families under (do) and over (nad) the age of 35. Translated rows: počet zarábajúcich s priemernou mzdou – number of earners with an average wage, počet zarábajúcich s minimálnou mzdou – number of earners with a minimum wage, počet detí – number of children. (source: NBS)