On Tuesday afternoon, Finance Minister Ladislav Kamenický announced a significant increase in the value-added tax on books from 10 to 23 percent.

“Books, as we have analysed, are primarily purchased by wealthier segments of the population, so they will be taxed at the basic rate,” PM Robert Fico’s minister said.

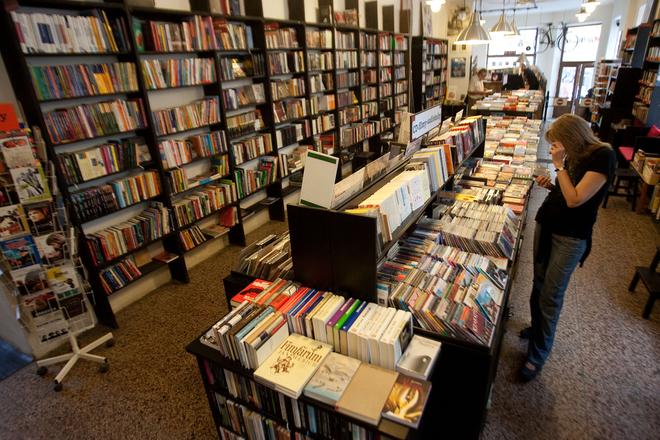

This measure is part of a broader plan to raise VAT across various sectors, with a few exceptions such as medicines, textbooks, and food. The increase aims to address Slovakia’s excessive public deficit, which has drawn criticism from the European Commission. The proposed VAT hike on books, in particular, has sparked widespread public discontent, with many mocking Kamenický’s comment. Memes and videos have emerged, showcasing people’s ‘wealth’ through their home libraries.

Kamenický aims to raise €50 million in 2025 through this particular VAT increase. His justification is based on an analysis by the Financial Policy Institute, which falls under the Finance Ministry. Today, books (excluding e-books) are subject to a 10 percent tax rate.

The government approved the consolidation measures on September 18, including amendments. However, even members of the ruling coalition have voiced their objections. Roman Michelko of the far-right Slovak National Party (SNS), who chairs the parliament’s culture and media committee, criticised the proposed 23 percent rate on books.

“Books. You want to buy books? Cheaply. Without VAT.” The image compares the planned higher VAT on books to the communist era in Czechoslovakia, when so-called “black market traders” (veksláci) would buy or sell foreign currencies or vouchers that people could use in Tuzex shops, which sold Western goods.

“I strongly disagree with the idea that only wealthy individuals buy books. Perhaps only spiritually wealthy. I see this as a proposal, not a fact,” Michelko remarked.