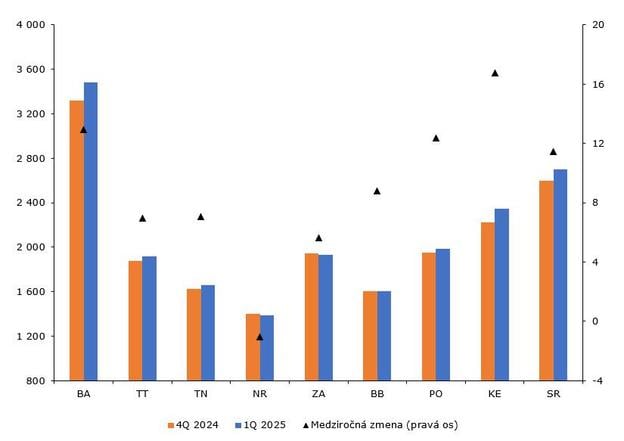

Slovakia’s housing market is showing renewed strength after two years of decline, though the recovery remains uneven. Property prices stopped falling roughly a year ago, but substantial increases are so far concentrated in economically stronger regions, including Bratislava, Košice and Trnava. Elsewhere, values are returning to previous peaks more slowly, according to the Slovak daily Denník N.

In the first quarter of 2025, national property prices rose by an average of 4 percent — the fastest quarterly increase since 2022, according to the National Bank of Slovakia (NBS). In the Bratislava Region, prices have already surpassed their historical highs. Košice follows closely, with values just 1.5 percent below their peak.

“The rise in prices has been driven mainly by apartments in Bratislava and Košice,” said Roman Vrbovský, an NBS analyst. He noted that older flats in Bratislava played a particularly important role, while smaller towns such as Senec, Pezinok and Spišská Nová Ves have also seen gains.

In central Slovakia, however, the recovery has lagged. Buyers are returning cautiously, unable or unwilling to pay prices comparable to those seen before 2022, when tighter monetary policy and higher interest rates cooled demand. Housing prices in regions such as Prešov and Žilina remain about 10 percent below their previous highs. In Banská Bystrica, the gap is even wider.

Given Bratislava’s weight in national statistics — the region accounts for more than half the country’s housing price index — its sharp gains have driven the national average higher. Most of the increase came early in the year, particularly in the apartment sector.

Older flats outpace new builds

Unexpectedly, older properties have outpaced new builds. While prices for new flats rose by 3.4 percent, older apartments jumped by 6 percent. Rising inflation expectations in the construction sector led many to anticipate higher prices for new homes, but “the data suggest otherwise,” Vrbovský said.

What constitutes a “new build” in Slovakia remains murky. Officially, properties less than two years old qualify, though developers often market homes still under construction as new. Real estate website Nehnutelnosti.sk applies a looser definition, classifying properties up to ten years old as new — though in practice, mislabelling is common. “Many so-called new properties were completed more than a decade ago,” said Michal Pružinský of Nehnutelnosti.sk.

At the start of 2025, a cyberattack on Slovakia’s land registry disrupted property transfers and mortgage approvals. Even so, banks issued almost as many new mortgages as in late 2024.

Supply rebounds

Supply has also begun to rebound after months of decline. The number of listings rose by 7 percent, driven largely by family homes. Yet demand remains robust. “Figures on contracts and asking prices suggest that demand remains strong,” Vrbovský said. Falling borrowing costs may sustain momentum: mortgage rates fell below 3.9 percent in March and continue to decline, reflecting easing eurozone inflation and prospects for further European Central Bank rate cuts.

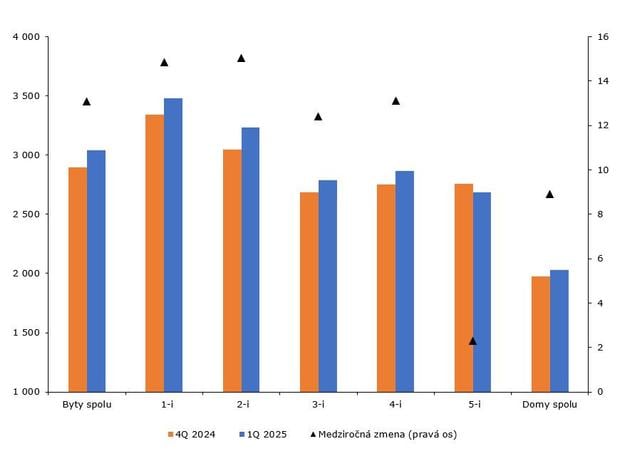

Average asking prices climbed 11.4 percent year-on-year to €2,700 per square metre, according to NBS data. Flat prices set a new record at €3,041 per square metre, led by two-bedroom apartments. Houses also became more expensive, rising 2.7 percent to €2,031 per square metre.

The sharp rebound has surprised some analysts. “Many expected a slowdown after last year’s rush to avoid higher VAT,” said Marián Búlik, a financial analyst with OVB Allfinanz Slovensko, quoted by the news agency TASR. “Instead, prices continued to climb.”

Older apartments remain central to this trend. “Sellers likely believe demand has strengthened enough to justify higher prices,” Búlik said. However, he cautioned that NBS figures are based on asking prices. Only data from the Statistics Office, drawn from completed sales, will confirm whether the higher prices were realised.

Analysts expect price growth to moderate later this year. “Annual growth should slow to around 7 percent in the second quarter,” Búlik said, noting that comparisons will then be made against the start of the recovery rather than the previous downturn.

Even so, demand shows little sign of waning, particularly for investment properties, which remain largely unaffected by proposed tax changes. With mortgage rates expected to approach 3 percent, market pressures may persist.

“The growing supply of homes is a positive sign,” said Tomáš Boháček, an analyst at 365.bank. “But strong demand and rising prices, particularly for older properties in desirable locations, point to a difficult environment for buyers as 2025 progresses.”

Renovation of a former military apartment building in the town of Jelšava on 11 April 2025. (source: TASR - Lukáš Mužla)

Renovation of a former military apartment building in the town of Jelšava on 11 April 2025. (source: TASR - Lukáš Mužla)

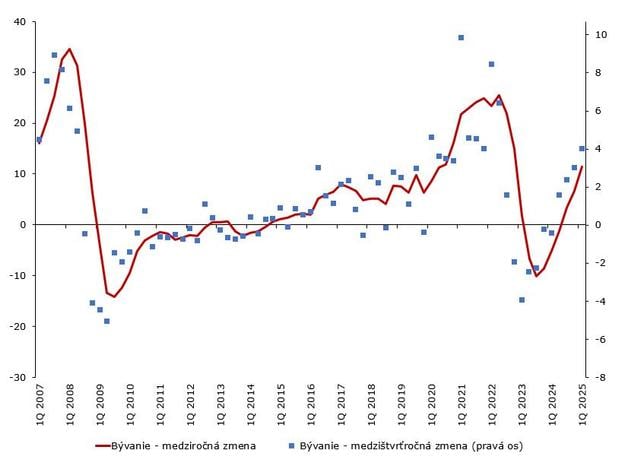

Housing price trends (year-on-year and quarter-on-quarter changes in %).

The red line shows the year-on-year change, while the blue dots represent the quarter-on-quarter change. (source: NBS)

Housing price trends (year-on-year and quarter-on-quarter changes in %).

The red line shows the year-on-year change, while the blue dots represent the quarter-on-quarter change. (source: NBS)

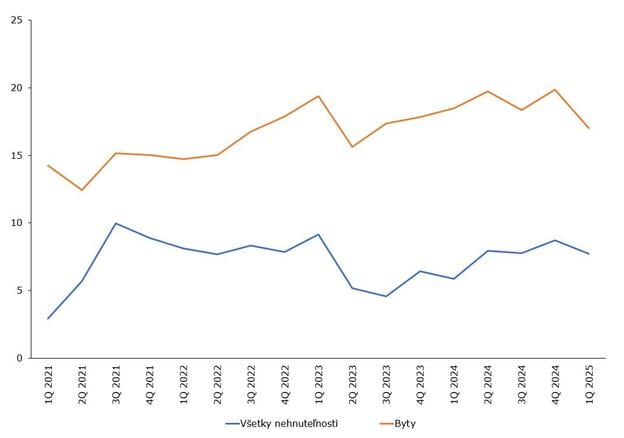

Prices of new and older properties (percentage difference). The blue line shows all properties, the other line shows flats. (source: NBS)

Prices of new and older properties (percentage difference). The blue line shows all properties, the other line shows flats. (source: NBS)

Trends in average flat and house prices (level in EUR/m², year-on-year change in %). Translation: flats total (byty spolu), 1-bedroom flat (1-i), ..., houses total (domy spolu). Triangles represent the year-on-year change (right axis). (source: NBS)

Trends in average flat and house prices (level in EUR/m², year-on-year change in %). Translation: flats total (byty spolu), 1-bedroom flat (1-i), ..., houses total (domy spolu). Triangles represent the year-on-year change (right axis). (source: NBS)

Housing price trends by region (level in EUR/m², year-on-year change in %).Triangles represent the year-on-year change (right axis). (source: NBS)

Housing price trends by region (level in EUR/m², year-on-year change in %).Triangles represent the year-on-year change (right axis). (source: NBS)