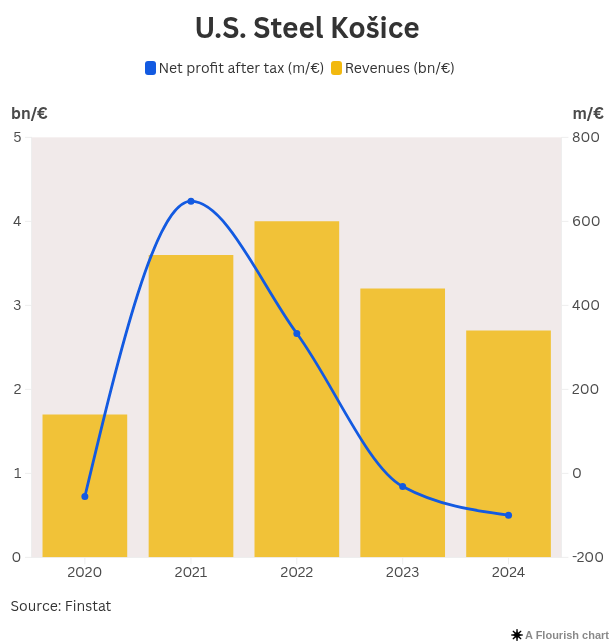

U. S. Steel Košice, one of Slovakia’s largest industrial employers, closed last year with a loss of €99.6 million, nearly triple the previous year’s deficit. Revenues also dropped sharply, falling by 15 percent to €2.7 billion, according to the company’s latest annual report.

It marks a second consecutive year in the red for the Košice-based steelworks, which posted a €31 million loss in 2023, according to Index. The company attributed last year’s deepening losses to a combination of unfavourable market conditions, falling average sales prices across all products, and rising operating costs.

Neither lower energy prices nor reduced spending on raw materials were enough to offset the downturn. In the final quarter of 2024, steel prices hovered around €700 per tonne — €100 less than the previous year. Meanwhile, steel consumption across the EU declined by 2.3 percent, driven by economic uncertainty, the war in Ukraine and a weakening industrial outlook.

Production at the Košice plant dropped to 3.5 million tonnes, down from 3.8 million the year before.

Though direct U.S. market exposure is negligible — more than 60 percent of output is sold within the Visegrád Four countries (Poland, Czech Republic, Hungary and Slovakia) and the remainder to other EU states — Slovak producers are wary of the knock-on effects of renewed protectionism.

In March, former U.S. President Donald Trump reintroduced 25 percent tariffs on steel and aluminium. Slovak industry leaders fear the move could trigger a reshuffling of global supply chains, making Chinese steel cheaper and more competitive in Europe, thereby squeezing demand for Slovak products.

Despite the gloomy figures and uncertain global climate, the company’s leadership remains cautiously optimistic. “Independent experts continue to view our company as a viable enterprise due to our strategic location and technical capabilities,” said company president James Bruno in the annual report.

Bruno also pointed to the potential benefits of a tie-up between parent firm U. S. Steel and Japan’s Nippon Steel. The $15 billion acquisition, initially blocked by President Joe Biden and criticised by Trump, is now the subject of a lawsuit. Trump has since signalled he may accept a minority stake for Nippon, and the Japanese firm has promised billions in investment — including possible upgrades at the Košice plant, such as transitioning blast furnaces to electric.

The U.S. Steel factory building in Košice (source: TASR - František Iván)

The U.S. Steel factory building in Košice (source: TASR - František Iván)