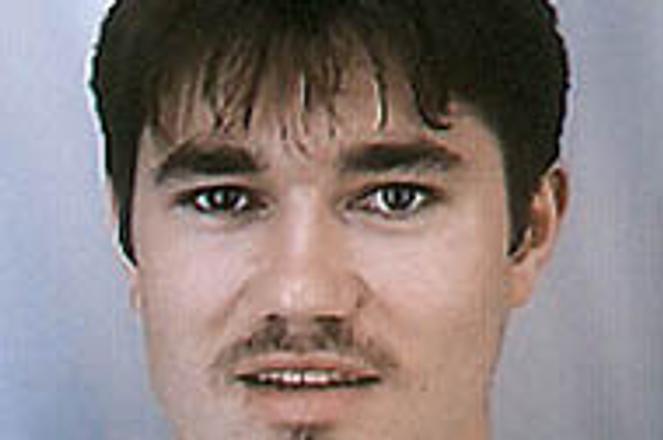

Tomáš Kmeť

In the last two months, the majority of local banks released their half year financial results. The most positive news is that Slovenská sporiteľňa (SLSP) and Všeobecná úverová banka (VÚB) have risen out of red numbers, mainly due to cuts in operational costs and the releasing of provisions. This was of course a direct effect of bank restructuring, which is finally over.

The state budget felt the cost of bank restructuring for the first time in July this year, when interest of 6.3 billion crowns on state-guaranteed loans came due. The government intends to finance the whole bank restructuring process with a loan from the World Bank, and may issue special 10 to 15-year bonds as well. However, the costs of restructuring should ultimately be repaid in the form of better results in the corporate and banking sectors.

The strong profits shown by Tatra banka were due to the weakness of other banks, and will likely fall as the health of the sector improves.

At first glance the half year results are positive and suggest significant improvement in the banking sector, however it would be wrong to expect an immediate increase in loan activities. It's true that the main purpose of restructuring the banking sector has been to provide a basis for restructuring the corporate sector, but it won't happen this or next year. Banks will be extremely cautious not to repeat mistakes resulting in a worsening loan portfolio.

The golden era of 'revitalising' the rigid corporate sector by providing uncovered loans through state-controlled banks to keep production and employment at artificially high levels is finally over. Healthy banks will create hard budgetary constraints for corporations, enabling cheap borrowing only by highly-rated clients. It will become more efficient for companies to achieve positive financial results than to avoid paying taxes by showing red numbers - a strategy that henceforth will result in worse credit conditions. Although on the short term horizon company restructuring will be fuelled only by a moderate increase of investment, the banking sector is on the right track and the economy might fully experience in three years the fruit of the government's decision to privatise banks.

Tomáš Kmeť is a sector analyst with state bank Slovenská Sporiteľňa. His Banking and Finance column appears monthly.

Author: Tomáš Kmeť