Business and shared services centres have not made significant investments in tangible or fixed assets in Slovakia. Their greatest wealth lies in their people – their education, expertise and experience. In this regard, they differ from other industrial sectors, says Marek Chudík, the newly appointed chairman of the Business Service Center Forum (BSCF) at the American Chamber of Commerce (AmCham Slovakia).

“Our value lies in human potential,” he said in an interview with The Slovak Spectator. “People are our key asset, and we devote our full attention to them. We aim to listen to their needs, understand their expectations, and work together – both among ourselves and with the government – to create the best possible working conditions for them.”

In the interview, Chudík further discusses the use of artificial intelligence, the negative impact of public-finance consolidation measures on the sector, and striking a balance between remote work and commuting to the office.

You will read in this interview

How will technology like AI reshape the workforce in business and shared service centres

What is the main asset of business and shared service centres in Slovakia?

What challenges do fiscal consolidation measures pose?

Has the sector found the right balance between remote and office work?

What are the biggest future challenges for the sector?

Recently, Slovakia has experienced several cyber-attacks targeting state institutions. How does the business sector, particularly the business services industry, perceive this threat?

Cyber-attacks are now a daily reality – not only for our centres but for the entire economy. We must learn to live with this threat. Companies have extensive security systems that we regularly test and update. Most of our members are part of multinational corporations where security measures are handled centrally. In Slovakia, we also experience cyber threats, but they are mostly attempts that we can detect and eliminate in time.

We continuously educate employees and management on cybersecurity, as every individual is a crucial link in the defence chain. I do not remember any successful cyber-attack on our centres, but we must always be prepared for all possible scenarios.

How would you describe the current state of the shared services sector in Slovakia?

The sector is in a stabilised phase. Our organisation represents 40 members with approximately 40,000 employees. While some companies have slightly reduced their workforce, others have expanded. There has been hiring in areas such as finance and accounting, marketing, and customer support. Overall, employment remains stable.

Over the past year, the number of employees in your member companies has declined from 37,849 to 36,930.

Yes, there has been a decrease of a few hundred jobs, but we still consider the situation stable.

Were there any relocations of highly specialised positions to other countries or sister centres?

In our sector, positions are frequently relocated, both to and from Slovakia, depending on where we see the best talent for specific roles. Some positions have indeed been moved abroad, but there has been no large-scale exodus of jobs.

Which jobs were eliminated, and for what reasons?

Mainly roles that are easily automated or where the latest technologies are now being integrated. If a job is relatively simple, repetitive and transactional, new technologies enable us to perform it automatically.

Automation is advancing in areas such as accounting, finance and administrative operations. More complex roles are being transferred to locations with specialised talent. Many companies are actively investing in robotic process automation (RPA) and AI solutions, which replace routine tasks and allow human resources to focus on more complex and strategic responsibilities. Some firms develop these tools internally, while others adopt solutions from their parent companies.

AI-powered chatbots and tools are also increasingly used in HR and customer support, leading to significant time and cost savings.

Chatbots are now widely used. In the past, they had a poor reputation due to their lack of sophistication. Has this changed?

Today, chatbots significantly reduce the burden of handling routine, repetitive queries, which were often time-consuming and unproductive. With the advancement of artificial intelligence, predictive reading, listening, and speech-processing capabilities, chatbots have become more efficient and well-received by employees.

The use of such tools requires significant energy. Do shared service centres in Slovakia feel the impact?

Data centres are highly energy-intensive, but it is not common practice to host them in Slovakia. Although shared services centres employ 40,000 people in Slovakia, they typically operate with data centres, storage or servers located abroad. Here, we are primarily powering laptops and office lighting.

Which countries are most suitable for data centre locations?

It depends on the company’s decision. Often, data centres are established in the country where the company is headquartered or where energy costs are significantly lower. Some firms also choose locations they consider strategic, and secure as data centres are substantial investments that require proper protection.

How do the recent fiscal consolidation measures in Slovakia affect your sector?

Any changes impacting the business environment also affect our sector, whether they relate to the transaction tax, new vouchers for employee sports activities, or income taxes. In general, our employees value flexibility. They want to manage their financial resources as they see fit.

For example, a few years ago, when meal vouchers were replaced with the option of receiving cash instead, most of our members chose the latter. From this perspective, any state or corporate intervention that earmarks part of employees’ earnings for specific activities is perceived negatively. Budgeting is about prioritisation – if more funds are allocated to one area, fewer remain for others. Payroll expenses are our main cost, and when money is directed toward sports vouchers, it cannot be used elsewhere.

On the other hand, we are looking for ways to adapt to these new conditions, such as optimising processes and improving cost efficiency.

Can you estimate how much the transaction tax will cost your members?

The transaction tax represents a multi-million euro burden for our members, reducing both corporate and employee flexibility.

Representatives of the automotive industry have stated that the transaction tax and other consolidation measures have rendered them uncompetitive compared to neighbouring countries, including Austria. Do you share this concern?

I wouldn’t describe the situation as dramatic. The business environment is not defined by a single policy but rather a cumulative effect of various risks. These accumulate over time, and government or parliamentary actions can either accelerate or slow their impact. In this case, we are seeing an accumulation of risks.

It is difficult to predict when this will reach a tipping point, as each company assesses risk differently. To my knowledge, none of our members is leaving Slovakia due to the transaction tax, but I also know that they are unhappy with the measure. Such policies make Slovakia less attractive for new investments.

How might these measures affect the arrival of new centres?

It will certainly have a negative impact. Every regulatory measure diminishes Slovakia’s attractiveness, though this is not a binary situation – Slovakia is not simply ‘attractive’ or ‘unattractive.’ Instead, it becomes more or less appealing compared to other locations. Whether this particular policy deters a company considering Slovakia remains to be seen, but it is possible.

Are there any confirmed plans for new shared service centres to be established in Slovakia this year?

I am not yet aware of any, but we are still at the beginning of the year. I would, however, be very surprised if no new centre were established. Slovakia continues to benefit from its strategic location, EU and NATO membership, economic stability, euro currency, and good infrastructure. These factors have been key selling points in our investment presentations for years. As long as we maintain these advantages, we can continue to attract new investments.

What developments do you foresee in your sector?

Business and shared service centres have become an established part of the national economy, and I expect stable growth. I do not anticipate another rapid expansion like we saw between 2000 and 2010, when employment in the sector skyrocketed during this decade basically from zero to almost around 34,000. However, neither do I expect a sharp decline. For that to happen, we would need to see several more risk factors accumulating.

Some centres may still grow, while others may shrink, but I believe employment will remain around 40,000 for the foreseeable future.

A number of business and shared services centres in Slovakia had the ambition of establishing themselves in the field of ESG (environmental, social and governance) and providing these services to their parent and sister organisations. How is the situation developing?

ESG has penetrated both our parent companies and centres in Slovakia. However, while ESG is a significant agenda, it is relatively small in terms of shared service centres. It doesn’t create a lot of room for some huge employment. So yes, opportunities within the ESG agenda have come to Slovakia, but I would guess that we could count the people working on their agenda in the double digits. These are very specific positions, and the fact that centralising services is usually built on volume and on a large number of relatively harmonised and standardised positions, this is not something that would be our priority. Most of our members are more focused on operational processes, financial services, accounting, IT and marketing.

In the past, the BSCF considered the current Labour Code to be insufficiently flexible. Has anything changed in this respect?

I am not aware of any changes to the Labour Code currently being addressed, although of course we would welcome any steps leading to greater flexibility. Whether it would be more flexible working hours, working from home or recruiting or transferring people. We would also highly appreciate if the Slovak government took concrete steps towards adopting an option for employers and employees to mutually agree on electronic delivery of work-related documents. Any untying of our hands could lead to the creation of more jobs.

Has the sector found the ideal balance between working from home and working in the office?

I do not think that a solution has yet been reached. My guess is that it will take us at least another 10 years before we as an industry agree on what the right model is. For many years before that, we were able to do five days in the office. During the pandemic, we proved that we could do five days from home. So the question is not what we can do and what we can’t do. The question is what is useful and expedient, whether for people or companies. And we are still searching for the right answer. We have some members who tend to be more flexible and we have other members who tend to be less flexible. Some have asked people to come back to work for the full five days. Some offer alternative approaches, with some number of days worked from home. Also, the Labour Code is a little bit limiting for us in this and limits the amount of flexibility we can give our employees.

What are the biggest challenges for the sector moving forward?

Automation, robotics, and AI-powered solutions are advancing rapidly, and we need experts who can develop, implement, and utilise these technologies. Fortunately, Slovakia continues to have a highly skilled workforce, which is the main reason why shared services centres have chosen to operate here. If we maintain our talent base and invest in innovation, Slovakia will remain a strong player in the industry.

Moving forward, critical thinking and workplace flexibility will be essential for both businesses and employees.

With what ambitions and plans did you take up the position of BSCF chair at the beginning of last year?

The BSCF was founded in 2014, more than 10 years ago. We face different challenges today than when the sector was growing and expanding rapidly. These challenges are mainly related to the business environment, regulations, taxes and various additional costs. Our challenge is to find a model that works for us, whether in the context of legislative changes or in the field of artificial intelligence, which is currently experiencing a significant boom. Equally important is the cooperation between our members, which is gradually changing – whereas in the past competition between companies prevailed, today we are moving into a period of greater cooperation and mutual dialogue. This is why our forum was created, to identify areas where we can work together effectively for the benefit of our companies and employees. I am very much looking forward to my new role and hope that we can find common ground not only among our members, but also in relation to government and other sectors of the economy. I believe that this collaboration will help to sustain employment and create new opportunities for people.

Marek Chudík, chairman of the Business Service Center Forum (BSCF) at the American Chamber of Commerce (AmCham Slovakia) (source: BSCF)

Marek Chudík, chairman of the Business Service Center Forum (BSCF) at the American Chamber of Commerce (AmCham Slovakia) (source: BSCF)

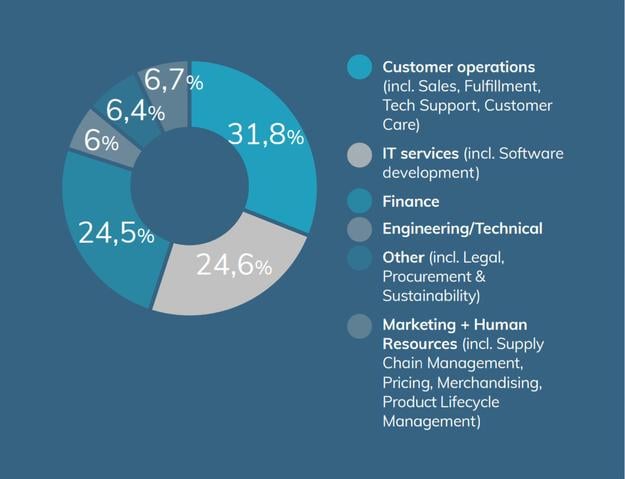

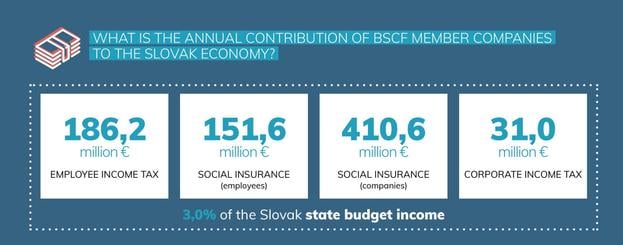

(source: BSCF)

(source: BSCF)

(source: BSCF)

(source: BSCF)