While Covid-19 continues to affect companies operating in Slovakia, it has not been the most important factor for the biggest companies when planning operations.

In spite of the ongoing pandemic, most of them expect an increase in revenues, profit, employment and investments.

“Covid-19 is still here and still plays a very important role even today, but companies have already made a positive shift compared to the previous year,” said Eva Kusá, senior tax consultant at the tax and audit advisory company BMB Partners, when introducing the results of its annual TAXparency report.

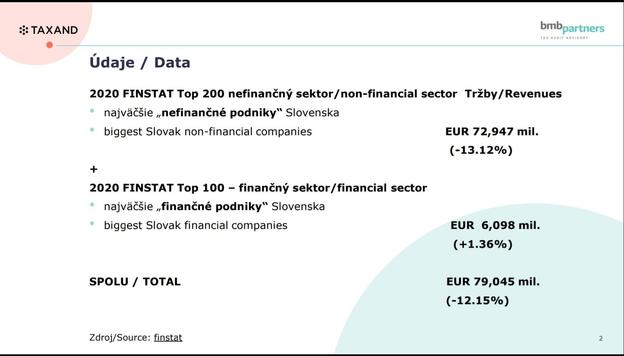

The report, subtitled Who Finances the State, presents the Top 200 biggest Slovak non-financial companies and the Top 100 biggest Slovak financial companies for 2020. These report total revenues of €79.1 billion, 12.5 percent down compared to 2019. Tax experts attribute this decline to the impacts of the pandemic and the chip crisis.

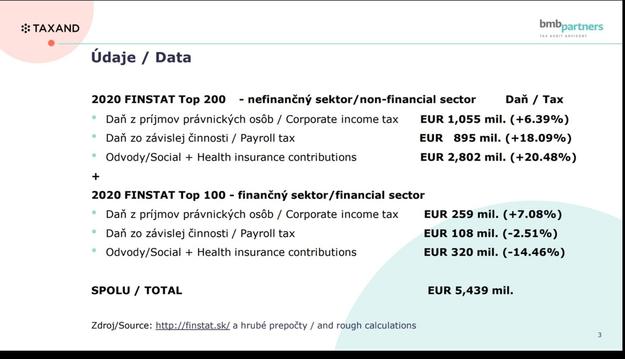

Contrary to this, total income taxes and levies, either those paid by the 300 biggest companies or their employees, increased by almost 13 percent to €5.4 billion. Judita Kuchtová, tax advisor at BMB Partners, ascribes this increase to the growth in income and payroll taxes paid by private individuals.

"The composition of the Top 300 companies in 2019 and 2020 is different when the latter had about 46,000 employees more," said Kuchtová.

The Bratislava plant of Volkswagen. (source: TASR)

The Bratislava plant of Volkswagen. (source: TASR)