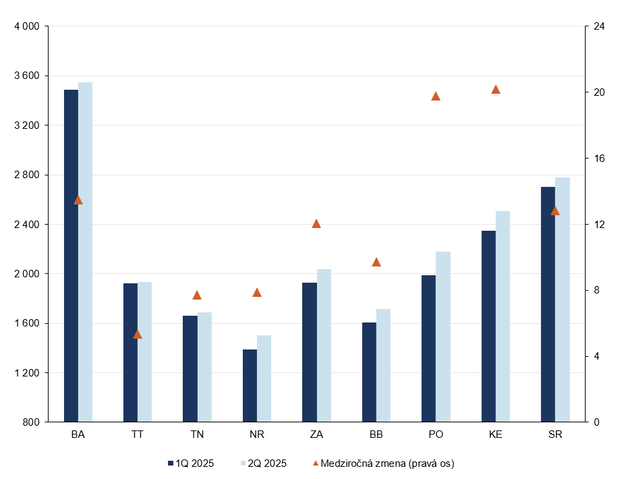

Slovakia’s housing market continued to defy economic slowdown in the second quarter of 2025, with residential property prices reaching new record highs. Despite broader signs of stagnation, the average asking price for housing rose by 2.9 percent compared with the previous quarter – and stands 12.8 percent higher than the same period last year, according to the National Bank of Slovakia.

Both flats and family houses contributed to the increase, with prices now exceeding the previous peak recorded in 2022, before the cycle of interest rate hikes began. While the capital, Bratislava, led price growth earlier this year, it is now being overtaken by other regions, particularly Prešov and Nitra, which saw the strongest quarterly gains.

Flats and houses continue to climb

The average price of a flat rose by €72 per square metre (m²) in Q2, reaching €3,113/m². This is 4.4 percent higher than the previous peak in the third quarter of 2022. Growth in flat prices slowed slightly to 2.4 percent quarter-on-quarter, but year-on-year gains remain strong at 13.2 percent.

The highest growth was recorded in five-room flats, while prices for four-room units remained unchanged compared to the previous quarter.

Detached houses also saw sharp growth, with prices rising by €67/m² to an average of €2,098/m² – a 3.8 percent increase on the previous all-time high. Quarterly growth in house prices accelerated to 3.3 percent, with year-on-year gains reaching 8.6 percent.

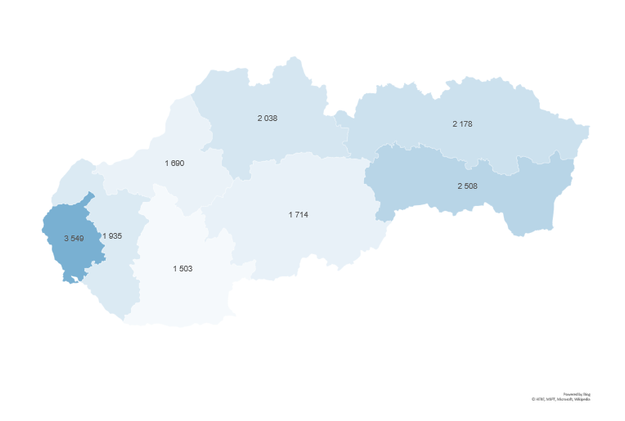

Regions catching up with Bratislava

Although Bratislava was the primary driver of national price growth at the start of 2025, its contribution has since diminished. In Q2, the capital recorded only a modest 1.8 percent increase. In contrast, several regional markets experienced far steeper rises.

The Prešov Region led the way with a 9.7 percent quarterly increase, followed by Nitra at 8.2 percent. Significant growth above 5 percent was also observed in Banská Bystrica, Žilina, and Košice – the latter recording its third consecutive quarter of growth.

In Prešov, the surge was driven by both flat and house prices in the Poprad and Prešov districts, as well as rising house prices in Kežmarok. In Nitra, increases were led by flat prices in the Nitra district and family houses in Nové Zámky.

Mortgage market rebound fuels recovery

The recent price surge follows a period of adjustment in Slovakia’s mortgage market. In 2022, ultra-low mortgage rates – often close to 1 percent – had fuelled a sharp increase in property prices. However, a wave of interest rate hikes that year triggered a sudden slowdown, from which the market is now gradually recovering, according to Slovak daily Denník N.

Since then, mortgage conditions have eased. The average interest rate on new housing loans has fallen to around 3.6 percent, down from 4.2 percent a year ago. This has helped revive buyer demand: the volume of newly issued mortgages jumped by 70 percent year-on-year in Q2 2025, reaching €1.8 billion.

Supply increasing, but still below last year

The number of property listings rose by 6.2 percent in Q2 compared to Q1, continuing the trend from 2024. However, compared with a year ago, total listings remain lower. This marks the second consecutive quarter of increasing supply, although last year saw a similar rise that stalled during the summer.

Flats accounted for a slightly higher share of listings, suggesting renewed interest from sellers in this segment.

Slovak (SR) regions

Western Slovakia: BA (Bratislava), TT (Trnava), TN (Trenčín), NR (Nitra)

Central Slovakia: ZA (Žilina), BB (Banská Bystrica)

Eastern Slovakia: PO (Prešov), KE (Košice)

April drives quarterly growth, mortgage activity lags behind

Most of the quarterly price growth occurred between March and April, with more modest changes in May and June. In May, only house prices increased, while June saw a renewed lift in flat prices.

Mortgage lending is gradually starting to align with housing market trends, though a divergence remains. A gap in early 2025 between price growth and mortgage activity – caused partly by technical factors – has narrowed but not fully closed.

Outlook

Despite a softer economic backdrop, Slovakia’s property market remains resilient. Regional markets are closing the price gap with the capital, while both demand and supply are rising. With prices at new highs, the central bank notes, the housing market continues to be a key – and potentially risky – component of the country’s economic outlook.