Standard & Poor’s affirmed Slovakia’s A+ sovereign credit rating on Friday but revised its outlook from stable to negative, warning that global trade tensions could pose a significant risk to the export-driven economy.

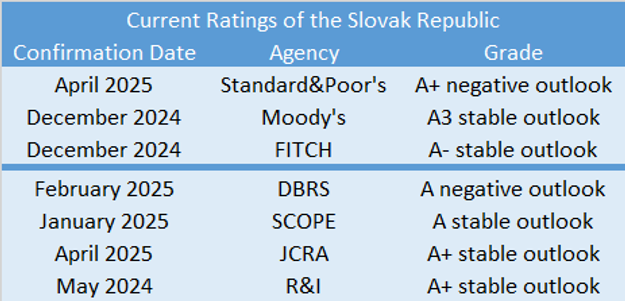

The announcement was met with cautious relief in Bratislava, where the Finance Ministry noted that Slovakia’s rating remains two notches above those assigned by Fitch and Moody’s. “The good news is that Slovakia has maintained its A+ rating,” the ministry said. “However, the uncertainty brought by the threat of global trade wars is worsening Slovakia’s outlook.”

In its assessment, S&P praised the Slovak government’s efforts to rein in public spending, projecting that the country’s budget deficit will fall to 4.7 percent of GDP in 2025 – in line with this year’s state budget approved at the end of last year. The government will soon present its third consolidation package for 2026. The agency also forecast economic growth of 1.6 percent in 2025 and 1.3 percent in 2026, driven largely by investments funded by the European Union and the recovery plan.

Nonetheless, analysts warned that Slovakia’s heavy reliance on car exports, particularly to Germany and the United States, leaves it highly vulnerable to global trade disruptions. “We have revised our outlook to negative, since Slovakia is highly export-oriented and the automotive industry is at risk of being affected by global trade tensions,” S&P said, pointing to growing uncertainty over potential tariffs from Washington in the coming months.

Finance Minister Ladislav Kamenický of the Smer party sought to frame the revised outlook as a consequence of global instability rather than domestic failings. “Maintaining the A+ rating, despite inheriting the worst public finances in the European Union, is positive news,” he said. “The revision reflects external factors, not government actions,” he added – ignoring the fact that previous Smer-led governments also contributed to the deterioration of Slovakia’s fiscal position.

Ratings from Fitch and Moody’s are expected in May and June, according to the finance minister. Kamenický, who harshly criticised Moody’s in December after the agency downgraded Slovakia to A3 with a stable outlook, accused it at the time of issuing a politically motivated and biased assessment.

“I am convinced that political work influenced Moody’s rating, which could damage the agency’s own reputation,” Kamenický wrote in a Facebook post on 16 December 2024. He claimed the Finance Ministry had submitted extensive objections ahead of the downgrade, warning of politicisation and inconsistencies in the debt data, but that Moody’s ignored them.

“They made no changes,” he wrote. “I leave it to your imagination what to think about that.”

Kamenický has since spoken with the agency, although he remains sceptical. “When someone forms a rating based on political views they read in liberal media, I cannot accept it,” he said on Sunday, 27 April 2025.

The latest S&P decision was also welcomed by Prime Minister Robert Fico, who criticised the domestic media for giving the story scant attention. Although the outlook is now negative, Fico stressed that Slovakia is not to blame.

“This is the result of global events, not our doing,” Fico said on Sunday.

Finance Minister Ladislav Kamenický (source: Sme - Marko Erd)

Finance Minister Ladislav Kamenický (source: Sme - Marko Erd)

(source: Ardal)

(source: Ardal)