The automotive industry is one of the pillars of Slovakia’s economy, bringing investment, employment and innovations with the planned Jaguar Land Rover plant in Nitra as the latest example. But the September 2015 emission scandal of one of the major car companies in the world, Volkswagen, seems to confirm that research and development into alternative fuels is the way forward.

More information about the Slovak business environment

Please see our Investment Advisory Guide.

This year’s edition was published also thanks to cooperation with the Investment Support Association (ISA). The general partner of the guide was the law firm Noerr.

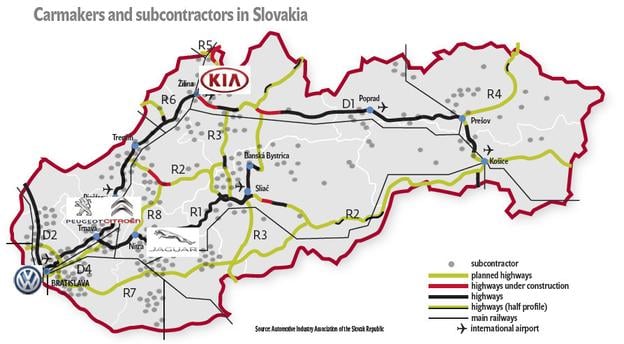

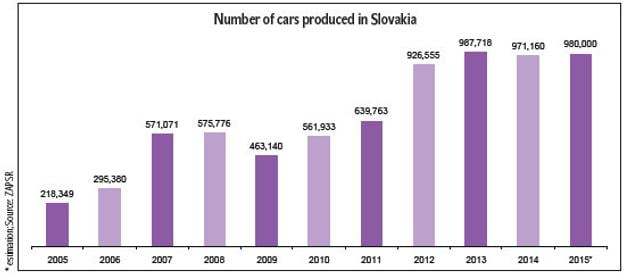

Slovakia is already home to three carmakers, Volkswagen Slovakia, PSA Peugeot Citroën Slovakia and Kia Motors Slovakia. Over the past 20 years, car production increased from 2,952 vehicles in 1993 to more than 970,000 in 2014. The latter figure, equalling 178 cars per 1,000 citizens, has made Slovakia the biggest per capita producer in the world.

“There are several viewpoints by which to define the importance of the automotive industry for Slovakia,” Juraj Sinay, president of the Automotive Industry Association of the Slovak Republic (ZAP), told The Slovak Spectator.

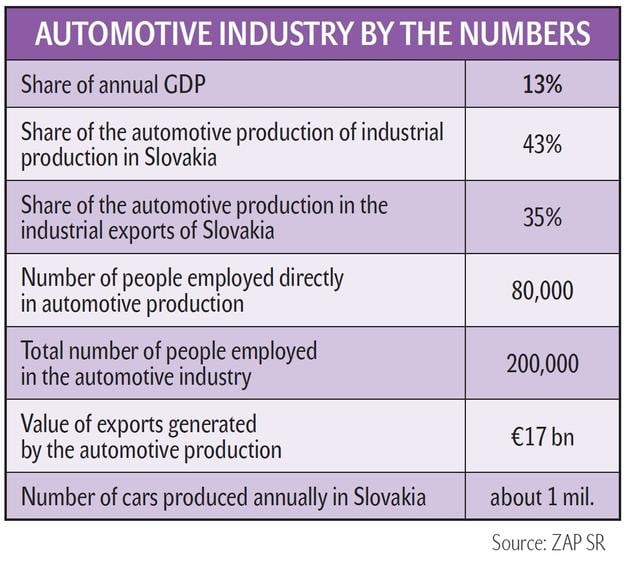

The car industry employs 80,000 people but when also subcontractors and other related sectors and services are included, the automotive industry gives jobs to more than 200,000 people. The automotive industry generates 13 percent of the gross domestic product (GDP) and makes up 43 percent of the total industrial production in Slovakia.

“The structure of production technologies in [automotive] companies in Slovakia includes the most modern solutions nearing alternatives of a digital company, which was also one of reasons why another important investor ponders investment in Slovakia,” said Sinay. “But these are only some of factors being cited by our foreign partners as an added value.”

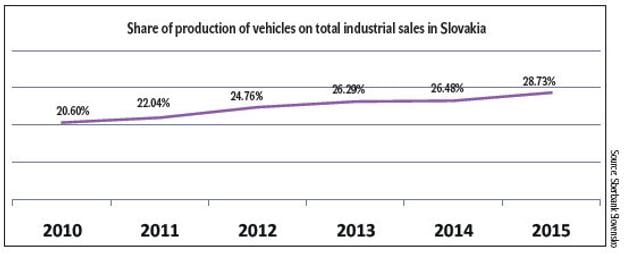

The importance of the automotive industry for the economy of Slovakia is gradually increasing, according to Vladimír Vaňo, head of CEE research at Sberbank Europe. Production of transport vehicles, which for the first time in 2010 represented more than 20 percent of total industrial sales has gradually increased its share of total up to 28.7 percent in the first half of 2015.

“Taken together with all the subcontractors, who are classified in other industries, the total share of the overall automotive cluster for the economy of Slovakia is even higher,” Vaňo told The Slovak Spectator.

The beginnings

After the fall of the communist regime in 1989, Slovakia’s arms industry was hit hard, Honorary ZAP Chairman Jozef Uhrík has recalled. Many companies were closed down, ousting hundreds of workers with specialised skills. That historical setting made the country fruitful ground for the automotive industry.

“The very successful mushrooming of automotive manufacturers in Slovakia was only possible thanks to an abundance of the underutilised key resource: a qualified labour force possessing the necessary craftsmanship for reliable production of some of the most advanced models of cars, including high-end SUVs,” Vaňo said.

Beyond a skilled workforce, a network of secondary vocational schools and apprenticeship institutes, as well as strong technical universities also remained from the communist era.

“The fact that a significant share of the automotive production in Slovakia represents high-end SUV models, which carry rather high price tags, points to the fact that the strength of the Slovak workforce is not in its price, but in the attractive ratio between the qualification and price of the workforce,” said Vaňo.

Multinational corporations with facilities in Slovakia could have produced these expensive models virtually anywhere in the world, if price were the only aspect in the decision-making, Vaňo said. The automotive industry and its subcontractors made not only the lion’s share of a contribution to increasing the potential output of the Slovak economy, but were also important players in bringing down unemployment from the near 20 percent levels experienced as recently 2001, Vaňo said.

“Compared to many other industrial sectors, the automotive industry still has a relatively high added-value, and can afford to pay relatively higher wages compared to many other industries and is hence a positive contribution to the overall increase in the living standards in Slovakia – albeit with significant regional disparities,” said Vaňo.

Not only an assembly line

“The statement that Slovakia within the automotive industry is only a cheap production hall has not been true for a while,” said Sinay.

The situation changed already before the end of the 20th century when the Slovak arm of the German carmaker Volkswagen finished the so-called complete knock-down (CKD) assembly, when a vehicle is assembled locally using all the major parts, components, and technology imported from the country of its origin. At that time VW started manufacturing highly specialised vehicles in Slovakia, including sports cars and 4x4s, recalled Sinay. Later VW launched the production of components and the assembly of gear boxes.

“Since this time only the most modern technologies requiring highly qualified labour force have been getting in Slovakia with any new investor and each new model manufactured in carmakers,” said Sinay.

Sinay also points to an increase of R&D capacities, which especially in case of subcontractors saw a big spike after 2000.

Several companies, especially from the group of subcontractors, have R&D centres in Slovakia, while the Automotive Innovation Slovakia Survey 2014 published by KPMG in December 2014 noted that as many as 26 subcontractors in Slovakia have their own R&D centres employing 700 people. Some 16 others are set to launch within three years. KPMG also sees prospects of inter-connection of established companies with the startup community.

Sinay lists as examples of successful R&D centres for Johnson Controls in Trenčín (development of interior elements), Matador Holding in Dubnica nad Váhom (development of components for automation of production as well as application of new materials), Continental Automotive Systems in Zvolen (development of braking systems), ZKW Krušovice (development of headlamps) and Plastic Omnium in Lozorno (development of integrated modules for car interiors).

“We are a proof that a Slovak R&D centre can be a successful link to the engineering network of a global company,” said Ivan Jakubec, head of development of seat components at Johnson Controls in Trenčín, as cited in the ZAP’s magazine Automotive Innovation Slovakia.

According to Jakubec, one of the most important factors is effective development of employees when the biggest challenge was to change the way of thinking of employees from the trial and error principle to the plan-do-check-act principle.

“The benefit for the [parent] company is an R&D centre strongly competitive in terms of abilities and costs,” said Jakubec.

On the other hand, the Centre of Development for the Automotive Industry at the National Technological Centre has thus far not been created amid bureaucratic infighting. Research and application-oriented organisations like VTT in Finland or Fraunhofer-Gesellschaft in Germany are looking for partners in Slovakia.

Electric cars

While Slovakia’s carmaking industry manufactures about 6,000 electric and hybrid cars annually, less than 300 such cars are currently on the country’s roads. The cabinet sees development of electric mobility as a chance for Slovakia to improve its environment as well as put an impetus on innovations and R&D and thus it adopted on September 9, 2015, the Strategy of Support of Electromobility.

While it sets ambitious goals in terms of the number of e-cars and plug-in vehicles to be seen on Slovak roads in a few years, it lacks any tangible support schemes.

“The strategy has been elaborated in efforts to help the development of the automotive industry in Slovakia and electric mobility in Slovakia as well as because of the support of the growth of the industrial production based on increase of its competitiveness via innovations and innovative technologies and because of creation of the Slovak platform for e-mobility,” according to an Economy Ministry statement.

“Slovakia, alas, has been lagging in this development not only behind leaders but also neighbouring countries in the region,” writes the ministry.

The strategy forecasts that between 600 and 4,000 electric cars and plug-in hybrid vehicles will take to Slovak roads in 2016 and 2017. Their number should increase to between 10,000 and 25,000 in 2020. By that time Austria and Germany should have 250,000 and 1 million such cars, respectively.

Sinay of ZAP points out that while the strategy focuses on electric cars and related infrastructure, ZAP’s interest is that conditions for application of all alternative drives of cars (various hybrid cars, LNG, CNG, LPG, hydrogen and others) are created.

“In this term we assess positively that the Economy Ministry has begun working on a material that will solve infrastructure for all these alternatives,” said Sinay. “But the strategic question is whether a developed infrastructure will secure the fulfilment of scenarios that more such cars will occur on roads and that our car fleet will be more ecological.”

Avoiding a Detroit-like scenario

Repeatedly there are raised voices pointing to an overly strong focus of Slovakia on the automotive industry, warning against the Detroit-like scenario. Analysts and experts see especially a bigger focus on education and innovations that would help Slovakia not to become a new Detroit.

ZAP in its strategic materials already in 2014 declared the basic conditions of competitiveness and sustainability of the automotive industry in Slovakia. It focuses especially on the field of education with creation of a system closer to requirements of the expert practice at all its levels.

“As far as there will be enough quality in Slovakia and qualified workers willing to work in production, there is no reason why the currently existing companies do not keep their production capacities here,” said Sinay. “Educated graduates are the basis of a prosperous company and this is regardless whether it is the automotive or any other sector of industry in Slovakia.”

Juraj Janči, general director of Coface Slovakia, believes that what is now important is to think ahead and invest into R&D even though not all investments would return.

“Already now it is necessary to think about development 20 years in advance,” Janči told The Slovak Spectator. “While in Europe and America it is necessary to think of sophisticated production with alternative fuels already today, this trend will come also to Asia sooner or later. The emission scandal [of VW] has finally pointed to facts, which many suspected, and that it is necessary to look for alternative fuels: at the beginning electric cars, then gas-driven cars and gradually hydrogen drive.”

To avoid Detroit-like scenario, Janči believes that Slovakia should invest more into R&D and count on “that only a portion of invested sources would return, but this can push us ahead”.

Vaňo of Sberbank recalls that the influx of automotive-related FDI before the global recession of 2009 was part of a decade-long process of restructuring of the automotive industry in Europe. This restructuring process could be in short described as the “geographic optimisation of cost base”, he said. In other words, a recognition that if manufacturers want to produce cheaper cars, which were increasingly in demand, they must adjust also their cost base accordingly. This led to the downsizing of the facilities in western Europe and the opening of new production capacities in the eastern Europe – with the Visegrad Group playing a prominent role within this process. The major central European automotive cluster spans the Czech Republic, southern Poland, Slovakia and Hungary.

“The second important thing to keep in mind is that an important part of the Slovak automotive industry is comprised of relative newcomers, who chose Slovakia as their springboard into the half-billion market of the EU,” Vaňo said.

Small- and medium-sized models have proven over the past few years their resilience also during economic turmoil, as many families decide to proceed with the renewal of their fleet, but trade down for more fuel and maintenance efficient vehicles. Moreover, these new entrants have proven to be rather successful in further expanding their still relatively modest market share. Now a growing slice of the market, these producers see their production being hit less even though the overall pie is shrinking, as they succeed to get a bigger slice of the overall market, according to Vaňo.

Third, one of the crucial reasons for investing in Slovakia is the availability of an underutilised labour force with attractive proportion of qualification to cost. Such a resource is not that easy to replicate in the short-term, plus the vast volume of the investment made into fixed assets puts a time limit as to when this investment will reach a break-even point.

“Certainly, in the perspective of several decades we must take the issue of better diversification of the Slovak economy seriously, but that is not a reason to feel ashamed for the quality of our underutilised craftsmanship,” said Vaňo.

Jaguar Land Rover in Slovakia

In mid August 2015 the British Jaguar Land Rover (JLR) carmaker, owned by the Indian Tata Group, announced its selection of the city of Nitra in western Slovakia as its preferred location for a new manufacturing plant after a robust analysis of a number of locations including Europe, the United States and Mexico. It signed a letter of intent with the Slovak government on August 11. It put Slovakia’s proximity to a strong supply chain and good logistics infrastructure as reasons behind its decision.

“With its established premium automotive industry, Slovakia is an attractive potential development opportunity for us,” Jaguar Land Rover CEO Ralf Speth said at the time. “The new factory will complement our existing facilities in the UK, China, India and the one under construction in Brazil.”

The plant in Nitra will be the first plant of JLR in continental Europe.

“This giant investment will be another important contribution to gross fixed capital growth in the upcoming years,” said Vaňo. “Much will depend not only on start of the production, but also on the time until it reaches its full potential capacity.”

Carmakers in Slovakia

Jaguar Land Rover (Nitra) - planned

Production: Annual capacity is projected at between 150,000 and 300,000 vehicles

Employees: Between 2,000 and 4,000

Total investment: Planned at more than €1 billion, construction of the plant may begin in 2016 and production in 2018-2019

Kia Motors Slovakia (Žilina)

Production: Since the launch of the serial production in 2006 Kia Motors Slovakia has manufactured more than 2.187 million cars, including more than 323,000 in 2014.

Employees: More than 3,800

Models of manufactured: Kia cee’d, Kia Sportage and Kia Venga

Total investment: €1.6 billion since its arrival in 2004

Source: www.kia.sk

PSA Peugeot Citroën Slovakia (Trnava)

Production: Since the launch of the serial production PSA Peugeot Citroën Slovakia in 2006 has manufactured more than 1.7 million cars, including 256,200 in 2014

Models manufactured: Citroën C3 Picasso and Peugeot 208

Employees: About 3,500

Total investment: About €1 billion since its arrival in 2003

Source: www.psa-slovakia.sk

Volkswagen Slovakia (Bratislava)

Production: Since the launch of the serial production in 1992 VW Slovakia manufactured nearly 4.05 million cars, including 394,500 in 2014

Models manufactured: Volkswagen Touareg, Audi Q7, bodies for the Porsche Cayenne, Volkswagen up!, Volkswagen e-up!, Škoda Citigo and SEAT Mii

Employees: More than 9,900

Total investment: More than €3.01 billion since its arrival in 1991

Source: www.vw.sk

ZAP expects that if the investment materialises, the impact of the arrival of a fourth carmaker would have effects similar to the positive impact of the existing carmakers.

“Each new investment of such a character has brought an increase of GDP and one could assume that this would happen also in case of JLR,” said Sinay. “It is possible to expect a boost of the dynamics of Slovakia’s economic growth.”

In case various forms of education are applied, the new carmaker may reduce the unemployment.

“Slovak employees will have contact with a new corporate culture and system of work,” said Sinay. “The motivation of young people to study technical fields and get a job in the highly prospective industrial sector with upper-standard remuneration will increase.”

In brief and in numbers, provided that the signing of the binding memorandum is concluded successfully, Vaňo estimates that the total volume of investment in 2016-2018 could be €2 billion. Provided the facility would kick-start its production in a similar manner as its predecessors, it could generate initially over €1 billion in sales annually, which might gradually increase to more than €5 billion in sales per year; total employment at the facility would initially exceed 1,500 and could thereafter climb close to twice the amount, while total employment at subcontractors could initially reach 5,000 and could gradually climb to nearly 9,000, overall. During the first phase, until 2018, this FDI might add a cumulative 0.7 percentage points to real GDP growth.

“Along with other expensive cars manufactured in Slovakia this is another proof that the strong point of Slovakia is not the cheap labour force but the attractive ratio between the price and qualification of the workforce,” Vaňo said.

Analysts and market watchers warn that the availability of labour force might be a problem as several companies are already complaining about the lack of qualified labour force. In this respect hopes are pinned on elements of the dual education scheme that are being implemented in Slovakia.

Vaňo also points out that the experience of the company with doing business in Slovakia will be more important than the plant itself.

“A potential good experience of the carmaker may be important for building a bridge to Slovakia for other investors from Great Britain or India, similarly as this happened in the case of South Korea [when several subcontractors have followed Kia Motors to Slovakia],” said Vaňo.

VW emission scandal

The emissions scandal of Volkswagen broke in mid September in the United States, when the company admitted that it had installed software that artificially reduced the readings of its nitrous oxide emissions in some diesel cars. About 46,000 of the 11 million affected cars are on Slovak roads. Experts and market watchers see it as too early to envisage impacts of this scandal on the Slovakia’s automotive industry, one of possible consequences might be less investments by VW, but also an end of the era of diesel engines so popular in Europe.

“It is too early to judge,” said Vaňo in late October. “One has to keep in mind, that the corporation has several brands and might thus be successful in diverting some of the unsatisfied customers from one brand to another. Likewise, the facility in Slovakia is producing several models of different brands.”

Dušan Pukač, head of sales at Coface Slovensko, agrees.

“In any case, focus of carmakers in Slovakia would be more environmentally-oriented,” he told The Slovak Spectator.

Vehicle production makes up 17 percent of total German industrial output which accounts for 26 percent of German gross value added, said Grzegorz Sielewicz, Coface economist for the central and eastern Europe region. As a result the automotive industry accounts for nearly 5 percent of the total economic output and makes up nearly 18 percent of total exports.

“The scandal with fake emission results hurts the German quality image significantly,” Sielewicz wrote. “However, its impact could spread out among other economies which are dependent on the performance of the German automotive sector. It includes CEE countries which were able to gather sizeable German FDIs and lots of CEE companies deliver their products for the final German production.”

The scandal does not only cause problems for VW, but also boosts discussions whether it would not be more beneficial to support electric cars and bring testing conditions closer to reality.

“Nobody will believe that VW cars are so much more harmful than Fords or Toyotas,” said Martin Jesný, analyst with the Slovak Automotive Institute, as cited by the Hospodárske Noviny daily. “Now maybe the system of testing will become more realistic.”