Surging energy, fuel and food prices caused inflation in Slovakia to rise to 12.8 per cent last year, the highest level in thirty years.

In 1993, when Slovakia became an independent country, inflation jumped to more than 23 per cent, the Statistics Office announced.

Last year's inflation also exceeded the previous record of 12 per cent from 2000.

However, in the past seventeen years annual inflation has never surpassed 5 per cent, reaching 3.2 per cent in 2021.

Expensive food

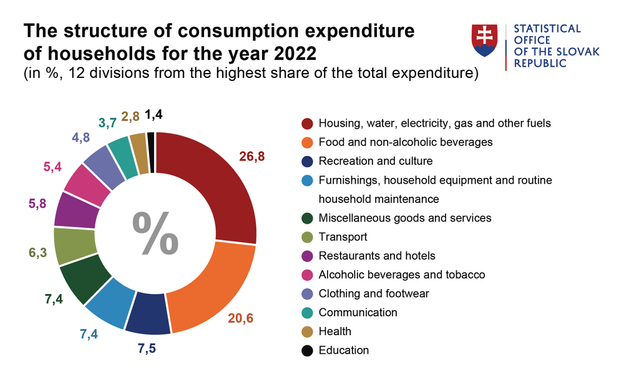

Last year households paid significantly more for food and non-alcoholic beverages and housing, in addition to energy. Together these items made up 47 per cent of a household's expenditure.

People in Slovakia regularly spent more money on these items than the average of all EU member states.

In 2022, prices increased in all 12 main categories of the universal basket of goods and services. Apart from food and fuels, this includes education, accommodation services, clothing, housing, health, and other.

Food prices, for instance, went up by 19.3 per cent compared to the average in 2021. The price of meat rose by 18 per cent, but dairy products, vegetables and bread were even more expensive. The Statistics Office said the price increases exceeded 20 per cent. The dynamics of oils and fats prices was even stronger, by 42 per cent, albeit not a very important item in the basket.

Last year, retailers in Slovakia struggled with supplies of sunflower oil, which led to a price hike.

Housing and energy saw an average increase of 15.5 per cent in prices last year, in particular due to rising electricity and gas prices at the start of 2022, pricier wood in the second half of last year, and expensive construction materials.

"For this reason, imputed rent rose by more than 18 per cent and the maintenance and repairs of dwellings by almost 19 per cent," the Statistics Office added.

Fuels, the third most important item in the basket, rose on average by 26 per cent last year when compared to the year before.

December inflation unchanged

Households' expenditures were higher despite inflation in December 2022 not increasing, remaining at November's figure of 15.4 per cent, the highest level in 22 years.

Still, prices continued to slightly rise last month compared to November 2022. Surprisingly, people paid 10 per cent less for fuels.

Analyst Jana Glasová of 365.bank thinks the situation was the outcome of a battle between retailers in the pre-Christmas period when they battled for customers.

Food prices have not decreased since summer 2021. Year on year, they increased by 29 per cent last December, especially milk, cheese and eggs. Customers paid 37.7 per cent more for them.

Prices will fall, but not significantly

Experts say prices will keep growing. Not as much as last year, they add.

"In particular, the relatively generous and widespread subsidisation of energy prices for households will contribute to this," said UniCredit Bank's analyst Ľubomír Koršňák. If the state had not intervened, he went on to say, inflation would have jumped to more than 30 per cent this January.

In 2023, the average inflation rate is expected to reach around 11 per cent. Inflation will still be affected by energy prices on the markets and the price of commodities in agriculture. The war in Ukraine will somewhat play a role as well.

Eva Sadovská, analyst from the Wood & Company firm, pointed out that inflation also impacts people's real salaries and savings in banks.

"2023 will be no different," she said.