Confidence among European investors in Slovakia is deteriorating for a second consecutive year, with many expressing concern over the country’s economic policy, sluggish demand, and a deepening labour shortage, according to a new survey of nearly 100 firms conducted in March.

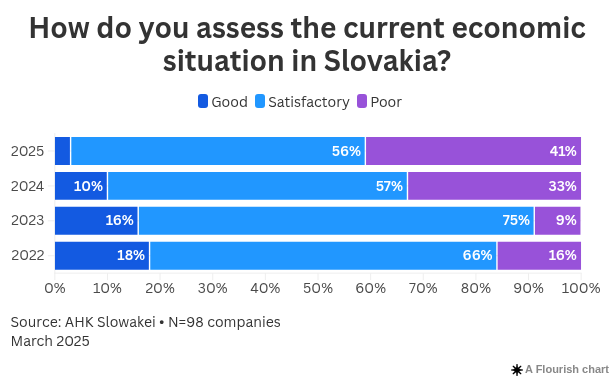

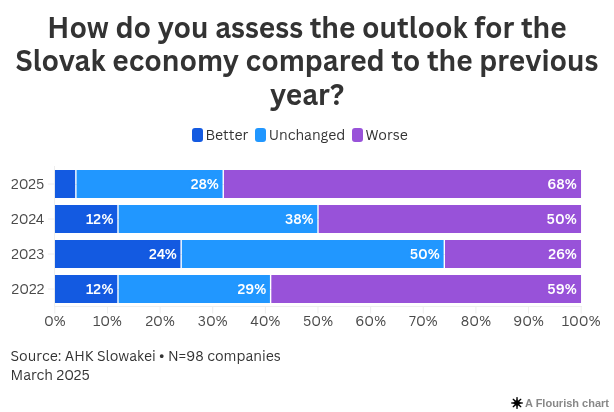

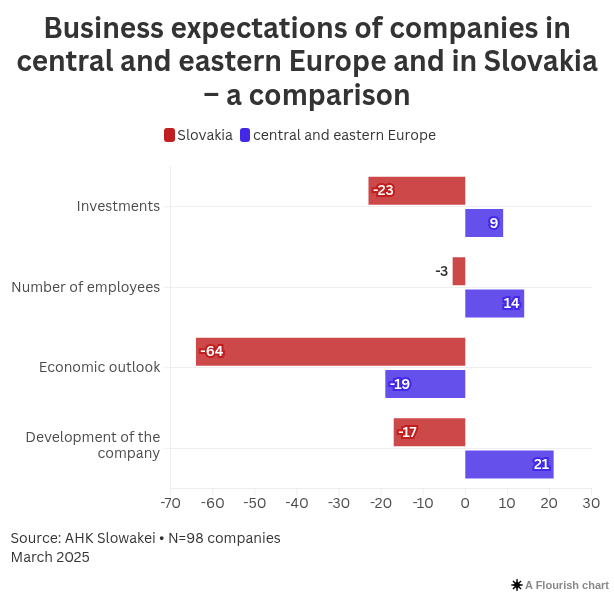

Only 3 percent of companies rated Slovakia’s current economic situation as good, while 41 percent described it as poor. The outlook is equally grim: a net balance of –64 percentage points reflects the gap between optimistic and pessimistic views of the country’s economic trajectory.

“Many firms remain under strong cost pressure, and global uncertainty is increasing,” said Pavel Lakatos, the newly appointed president of the German-Slovak Chamber of Commerce (AHK Slowakei), which conducted the survey.

Expectations for individual business performance have also weakened. While 31 percent of firms still consider their own situation favourable, a growing share expects conditions to worsen, dragging the net business outlook down to –18 percentage points.

Investment activity has plummeted. A net 24 percent of companies expect to reduce investment, marking a troubling trend for Slovakia’s competitiveness. “We’ve seen a continuous decline in firms’ willingness to invest since last year. This is a warning sign. Without investment, innovation and competitiveness suffer,” Lakatos warned.

The labour market remains under strain, with 53 percent of respondents identifying the lack of skilled workers as a major risk. This talent shortage continues to drive up wage costs, which are projected to rise by nearly 8 percent this year — another blow to companies already grappling with two years of record inflation.

Half of the surveyed firms now consider wage costs a principal threat to business growth over the next 12 months. Bettina Trojer, commercial counsellor at the Austrian Embassy in Bratislava, noted: “It’s a consequence of persistent inflation and a long-standing lack of qualified labour.”

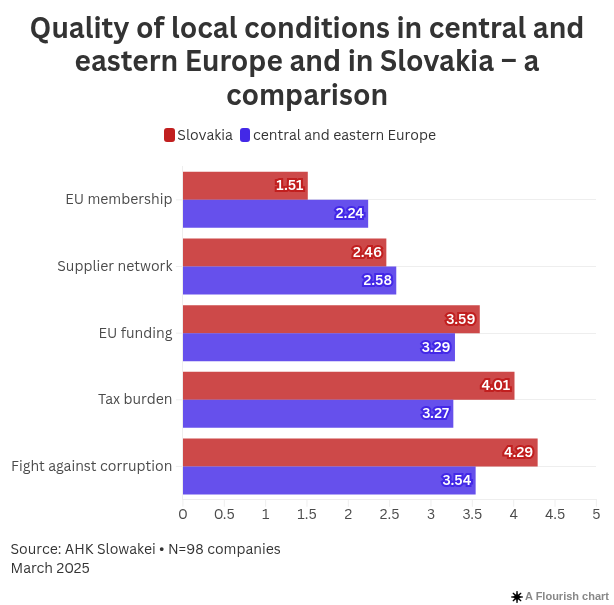

The dominant concern, however, is the country’s economic policy framework. Nearly 60 percent of respondents cited regulatory uncertainty and tax burdens as the most significant risks to growth. “The results clearly show that investors today value political stability and predictable conditions above all,” Lakatos said.

In particular, firms sharply criticised Slovakia’s increasing tax and social contributions, following a recent fiscal consolidation package. They also expressed growing dissatisfaction with public procurement transparency and anti-corruption measures, all of which received worse ratings than the year before.

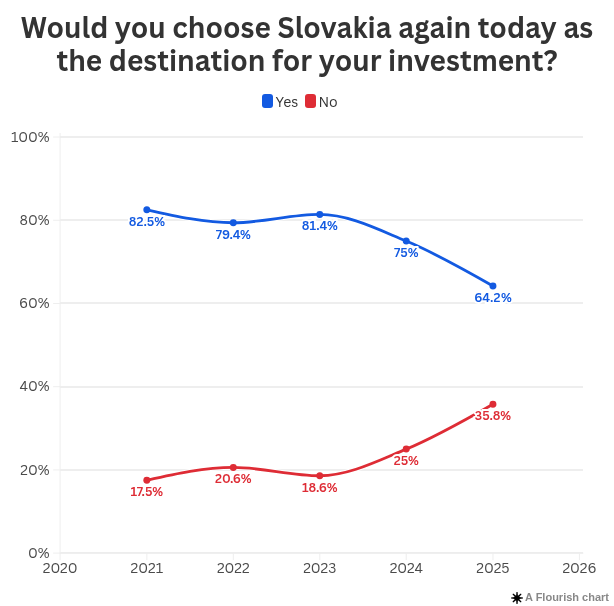

Despite these concerns, Slovakia retains some appeal. Sixty-four percent of the foreign firms surveyed said they would choose to invest in the country again, highlighting strengths such as its EU membership, ICT and energy infrastructure, and the reliability of local suppliers.

“There is a dense supplier network here, which is a valuable asset for diversified supply chains,” said Trojer. “What’s encouraging is that both the number and the technical quality of local suppliers are improving.”

But with dwindling investment intentions and heightened policy anxiety, the findings signal a country at risk of losing its competitive edge — unless it can restore clarity and confidence in its economic direction.

Survey

Survey period: March 2025

Participants: Companies operating in Slovakia, 81 percent of which are owned by entities based in other European countries

Number of respondents: 98 companies

Sector breakdown: Industry (52 percent), trade (9 percent), services (37 percent)

Organisers: ADVANTAGE AUSTRIA Bratislava, German-Slovak Chamber of Commerce (AHK Slowakei), French-Slovak Chamber of Commerce, Netherlands Chamber of Commerce in the Slovak Republic, Swedish Chamber of Commerce in the Slovak Republic, Slovak-Austrian Chamber of Commerce

A featured startup at the 2025 Innovation Festival, held at the New Synagogue in Žilina on Tuesday, 13 May 2025. (source: TASR - Daniel Stehlík)

A featured startup at the 2025 Innovation Festival, held at the New Synagogue in Žilina on Tuesday, 13 May 2025. (source: TASR - Daniel Stehlík)