Individuals and legal entities that are authorised to do business in Slovakia, and whose investment activities and projects meet the conditions of the Act on Investment Aid (Act 561/2007 Coll. on Investment Aid) are eligible for investment aid. Recently this act has been amended and new rules entered into force since April 1, 2015.

More information about the Slovak business environment

Please see our Investment Advisory Guide.

This year’s edition was published also thanks to cooperation with the Investment Support Association (ISA). The general partner of the guide was the law firm Noerr.

Types of investments eligible for support

Industrial production

Technology centres

Strategic service centres

Tourism

Forms of investment incentives

If an investor meets the set conditions, it can apply for the following types of state aid:

a subsidy for the acquisition of non-current tangible or intangible assets

income tax credit

a contribution for new jobs

transfer of real estate

Zones

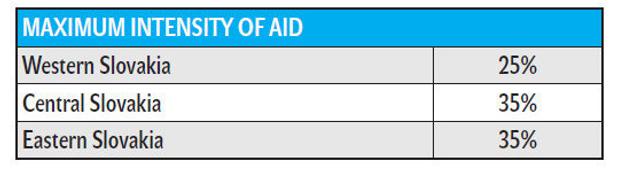

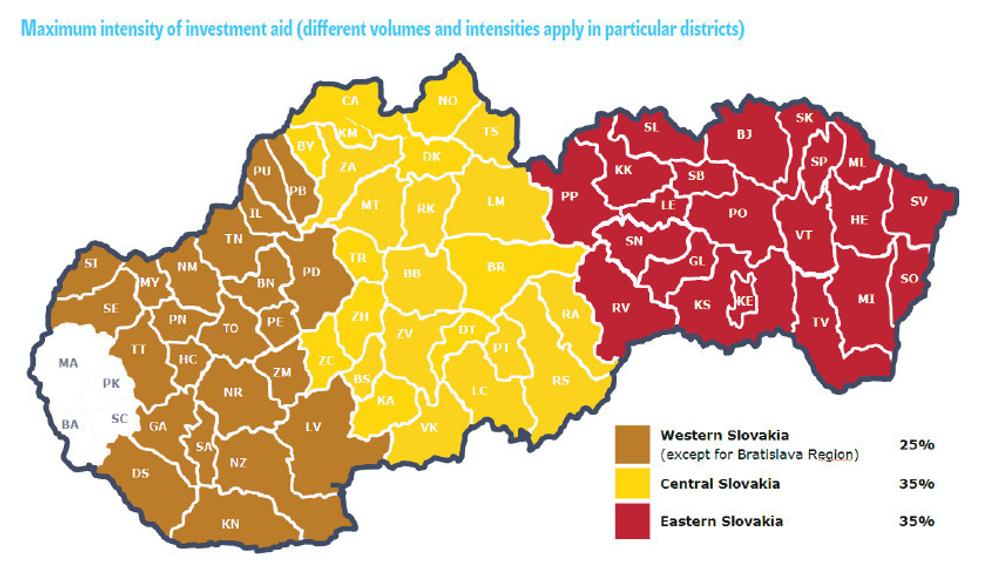

Overall aid from all sources is limited by EU legislation and divided into several categories. For this purpose, Slovakia is divided into three parts – western, central, and eastern. In contrast with the previous legal regime, cash forms of investment aid can be granted in all regions. In the past, companies in western Slovakia could apply for corporate income tax credits.

Conditions for industrial projects and tourism

The investment projects can be supported, provided they meet the following conditions:

Industry

the building of a new business, the expansion of an existing one, the diversification of production to new products which were not manufactured before, or a radical change in the production programme of an existing business

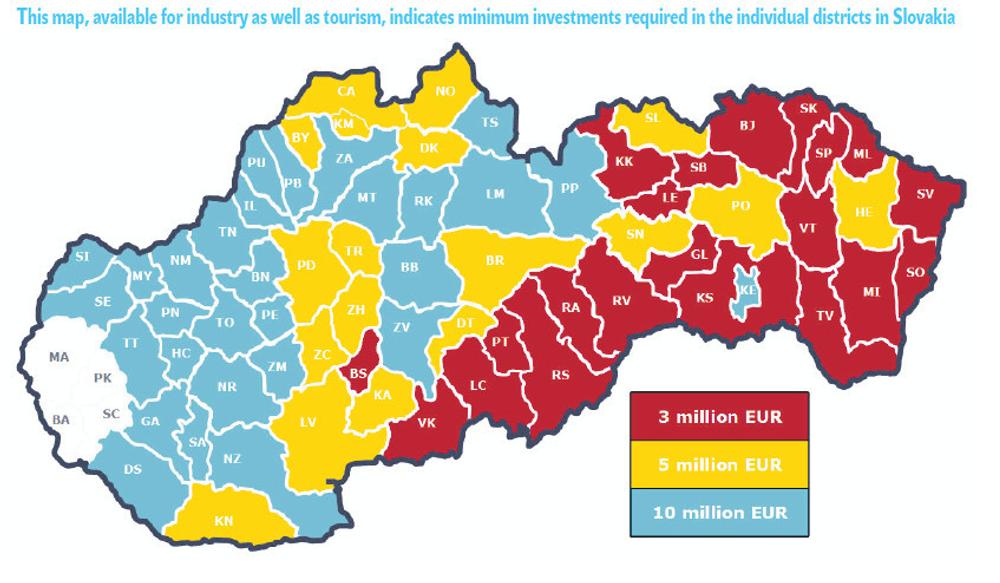

the acquisition of non-current tangible and intangible assets at no less than €10 million, €5 million or €3 million while not less than 50% must be covered by business’ equity or assets

the acquisition of new production and technological equipment designated for production purposes

reaching the required share of new technology from the total amount of eligible costs (60%, 50% or 40%)

creation of new jobs – increase of the overall number of employees by at least 40

Tourism

the construction of a new comprehensive tourism centre or an expansion of an existing one by offering new services

the acquisition of new technological equipment designated for offering of services

reaching the required share of new technology from the total amount of eligible costs (40% or 20%)

the acquisition of non-current tangible and intangible assets at no less than €10 million, €5 million or €3 million while not less than 50% must be covered by business’ equity or assets

creation of new jobs – increase of the overall number of employees by at least 40

Technology (R&D) centres

Conditions for granting investment incentives to the technology centres include:

the construction of a new technology centre or expansion of an existing one

the acquisition of non-current tangible and intangible assets valued at no less than €500,000, while not less than 50% must be covered by business’ equity or assets

creation of new jobs – increase of the overall number of employees by not less than 30

at least 70% of the total number of staff of a technology centre must have a university education

Business service centres

Conditions for granting investment incentives to the strategic service centres include:

the construction of a new strategic service centre or the expansion of an existing one

the acquisition of non-current tangible and intangible assets valued at no less than €400,000 while not less than 50% must be covered by business’ equity or assets

creation of new jobs – increase of the overall number of employees by not less than 40

at least 60% of the total number of staff must have a university education

Author: Lucia Guzlejová - senior consultant at PwC in Slovakia

(source: TASR)

(source: TASR)

(source: Sme)

(source: Sme)