Slovakia – with its national population of 5.4 million, around the size of cities such as Singapore, Santiago or Sydney – will probably not grow into a global leader in research and development (R&D) anytime soon, if ever. But just as this 17-year-old country managed to surprise the world by kicking out the former World Cup titleholder Italy from the 2010 football championship and advancing to the semi-finals, Slovakia is ready and capable of producing some surprising results in the R&D world. The potential need needs just to be tapped further.Only a few users running the NOD32 anti-virus programme to safeguard their computing equipment know that the application was created by the engineers of a Slovak company – ESET – that is still Slovak-owned and managed. The company received the 63rd award in the VB100 test – a highly regarded, independent anti-virus testing procedure – making the NOD32 application the global leader in its field. ESET holds third place in Deloitte’s Central Europe Technology Fast50 with its 530 percent annual growth over the last five years. Who would have ever thought that this small and seemingly less-developed country would be providing the best security for personal computers across the globe?In 2002, the European Council meeting in Barcelona declared that in order to “close the gap between the EU and its major competitors, there must be a significant boost in the overall R&D innovation effort” and laid out a spending target of 3 percent of GDP for R&D and innovation by 2010, with two-thirds of this investment coming from private sector sources.

Slovakia, indeed, has budding potential for R&D and has taken some large strides in its technological development. Many western visitors, for example, are often surprised when they learn that buying a ticket on public transport or paying for car parking in downtown Bratislava can be done via a simple mobile text message. Some visitors are also startled when they see the option for self-checkout scanning at many Tesco stores. And most people surely aren’t aware that in 2009 fibre-to-home broadband connections were available to 20 percent of the households across Slovakia – behind only Japan and South Korea among all the OECD countries.

Despite these technological advances, Slovakia has not had a huge number of major R&D success stories. But the successes that have unfolded so far show a strong potential for further advancement in both the private and governmental sectors, and foreign investments have clearly brought along the possibility for more intensive R&D in Slovakia.

Foreign firms tap Slovak capabilities

Siemens is one example of a large firm that is active in the R&D field in Slovakia. The company entered the Slovak market in 1993 and became one of the country’s largest foreign investors and employers. As of September 30, 2009 the company had ownership shares in 12 firms and employed almost 5,000 people while its revenues reached €661.8 million for the fiscal year 2008-2009. More than 10 percent of Siemens’ workforce in Slovakia is working on developing software applications for the health-care, energy, and telecommunications sectors.

The company’s development team in Košice in eastern Slovakia created a software application capable of transforming ultrasound into 3-D images. Thus Slovak developers helped to unveil the first system in the world to produce non-stitched, real-time, full-volume 3-D images of the heart in one single heart cycle. Siemens’ team in Slovakia has also made a major contribution to medical technology; a gentler, minimally-invasive technique for cancer treatment.

Košice and Banská Bystrica are also homes to the NESS KDC software development centre which focuses on software development and testing as well as related specialised services for NESS customers from the USA, Great Britain and other western European countries. NESS in Slovakia currently employs 300 developers.

Another success story comes from Alcatel-Lucent in the evolution of mobile communications technology. Large volumes of transmitted data and new applications are putting more demands on existing networks and a fourth generation of mobile communications is now coming on stream. LTE, or Long Term Evolution technology, which can bring faster speeds, higher transmission capacities and cheaper calls and internet connections through mobile networks, is regarded as a key aspect of this fourth-generation technology. The Bratislava-based R&D centre of Alcatel-Lucent, a worldwide telecommunications company delivering voice, data and video communication services to end-users, is writing part of this evolutionary history. Its Bratislava R&D centre was launched in June 1997. Bratislava was selected at that time in an internal competition with Romania and Poland. Currently the centre has about 100 employees involved in R&D.

The German chemical consortium Evonik Industries made its Slovak daughter company, Evonik Fermas, the R&D facility for the company’s network of Evonic-owned subsidiaries in its business line for the biotechnological manufacture of amino acids. After successful testing and pilot production in Slovakia, the production of sophisticated amino acids and their derivatives has not moved to labour-intensive Asian markets but rather to the high-end US market.

Production of automobiles has a very strong position in Slovakia but R&D projects in this important sector show that there is potential for further positive growth. Two of the first examples are ON Semiconductor with its Design Centre in Bratislava and Johnson Controls – a world-leading supplier to the automotive industry – which opened an International Technology Centre in Trenčín dedicated to research and development of car seats, dashboards and other advanced automotive industry components. In 2009, almost 500 highly-skilled Johnson Controls employees were working on testing, simulation and development of prototype parts for the automotive industry. The centre cooperates with other Johnson Controls facilities and with automotive manufacturers across Europe, including VW, Kia Motors, BMW and Mercedes. ON Semiconductor’s Design Centre is dedicated to new integrated circuit product development, specialising in linear regulation for the automotive market.

Nitra could become the centre of electric-car development for the Italian carmaker Fiat, the SITA newswire wrote in April 2010. The company wants to launch an R&D centre at the Technical Faculty of the Slovak University of Agriculture in Nitra to work on electric-car technology. Representatives of the Italian technology developer Mare Engineering have already discussed the plan to establish the R&D centre with the university’s management and this investment could signal another positive trend.

Is academia a cradle of R&D?

Slovakia has three main educational hubs or academic centres. The most advanced is in the west of the country consisting of Bratislava, Trnava and Nitra. Bratislava alone is home to approximately 65,000 university students mostly split between the nation’s oldest multi-disciplinary university, Comenius University with 29,000 students, the University of Economics (13,000 students) and the Slovak University of Technology (19,000 students) with its faculties specialising in engineering, material sciences, chemical technologies, informatics and computer sciences.

The mid-sized cities of Trenčín, Žilina, Banská Bystrica and Zvolen in central Slovakia are predominantly served by the University of Žilina (12,000 students), the University of Matej Bel in Banská Bystrica (14,000 students) and Alexander Dubček University in Trenčín (8,000 students). In the eastern part of the country, the university centres are primarily in Košice and Prešov, with a limited number of students in Poprad. Košice, the nation’s second most populous city, boasts a student population of about 26,000 and is home to the Technical University of Košice (TUKE) with its 17,000 students.

Historically, the Slovak education system has been geared towards making students memorise information but there is now a larger pool of talent in engineering sciences. Unfortunately, these graduates of engineering sciences are generally not yet equipped with the managerial skills necessary to succeed in today’s competitive global scientific environment. Combined with a lack of financial resources flowing into R&D and public education, this has contributed to stagnation in Slovak science and research.

The Academic Rating and Ranking Agency (ARRA) of Slovakia reported that the number of publications by Slovak scientists published in a database of the 10,000 highest-impact academic journals worldwide (jointly referred to as the “Web of Science”) increased by only 14.0 percent between 1995 and 2006, while the same indicator increased by 99.5 percent for the Czech Republic and by 113.5 percent for Poland. ARRA also conducted research to identify the number of world-class scientists working in Slovakia based on several criteria such as total number of publications or peer quotations acquired. The agency concluded there are 23 world-class physics researchers working in Slovakia, followed by 21 researchers in the field of chemistry, four each in biology and medicine and two in geological sciences.

However, a few recent initiatives show hope for the future. Students at the Slovak University of Technology (STU) in Bratislava (BA) created a STUBA Green Team with the purpose of developing, designing and manufacturing a fully operational electronic racing vehicle. Students from the departments of electrical engineering, applied mechanics, and manufacturing systems came together to build an electric, Formula-type vehicle, which finished 12th in a competition in Hockenheim, Germany, on August 27 this year but received first prize in the cost category. The team built their car at a lower cost than all other teams in the competition and in its second race in Torino, Italy in early October it finished 4th, behind the University of Stuttgart, the University of Zurich and the University of Aachen.

R&D has also come from Slovak hands

“I live in Slovakia, I do business in Slovakia and I enjoy it here,” Miroslav Trnka, general manager of ESET and co-creator of NOD has said. “I know how people do business in other countries and I see differences in the way they do business and in the way they work. I would rather restrain from judging which way is the better one. But in Slovakia, we still have people who don’t do things within the pre-set norms.” According to Trnka, this has helped Slovak developers to seek more effective ways to do things while bringing forth new ideas.

The state-supported Slovak Academy of Sciences (SAV) has also been trying to jump aboard the R&D train. An Austrian company, Alulight International GmbH in Ranshofen, in cooperation with SAV scientists, developed a new aluminium foam material. The product won the “Application Award” at CELMET 2008 in Dresden, Germany for cellular materials that were successfully applied in the real world. This invention has substantial application potential in the automotive industry and it has already been used in Ferrari racing cars and the Audi Q7. New applications for this material are undergoing testing and it is likely that trains and railcars in Austria and Germany will soon incorporate this aluminium foil because of its lower weight, higher durability, and better capability to withstand stronger impacts than materials currently used.

Slovak lighting producer OMS has taken a less traditional approach to its growth and development. The company’s general director, Vladimír Levársky, told the Hospodárske Noviny daily that OMS was seemingly quiet for a very long time. But it worked on its internal development and grew into a strong company out of the sight of competitors. Over the past 15 years, OMS has moved from the production of lighting to the development and design of lighting systems. “Nowadays we have our own research and development team and designers and we are able to bring in our own solutions,”

Levársky told The Slovak Spectator in earlier interview. This year OMS plans internal investments of €7 million with half of that going into its R&D centre. Almost 40 specialists in the centre are developing new products for OMS, focusing on energy efficiency and application of LED technologies.

Another Slovak R&D success story involves the Virtual Reality Media company (VRM) which as a small 8-person hardware and software trading company took on the challenge in 1995 of creating a MIG flight simulator for the Slovak Ministry of Defence. The company has now grown into a 75-person business that builds sophisticated flight simulators for various customers in the commercial aviation and defence sectors worldwide. Its location in Slovakia provides a significant cost advantage. Today, VRM is the only company within NATO or the EU offering flight simulators for Mi-17 helicopters.

R&D is still poorly financed

All the Slovak governments since that EU declaration have vowed to support domestic R&D and a knowledge-based economy and their statements have more or less followed the EU targets. Unfortunately, reality does not seem to have followed the rhetoric.

The country has primarily been subsidising investments that support mass levels of employment and thus are situated in relatively less-sophisticated economic sectors. Even though Slovakia has succeeded in becoming the global leader in cars produced per capita, it is still way behind in terms of money channelled into R&D as a percentage of GDP and the country’s proposed budgets to 2013 follow the same pattern.

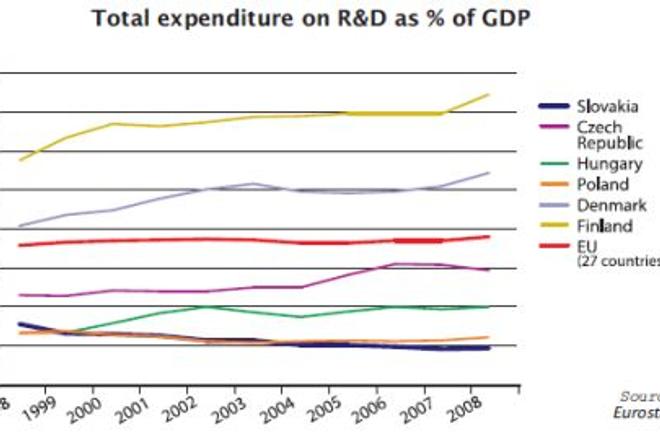

In 2007, Slovakia announced that it would invest 1.8 percent of its GDP to finance R&D. In reality, R&D expenditures in Slovakia have been oscillating at around 0.5 percent of GDP ever since 2002.

While Slovakia invested 1.38 percent of its GDP in R&D in 1993, the ratio dropped to 0.55 percent in 2009 and is budgeted to drop further to 0.36 percent in 2013. In 2008, Slovakia’s R&D expenditures stood at 0.47 percent and the country was outperformed in R&D spending by every single EU member state except Cyprus. Its investment level fell far below the EU average of 1.9 percent according to data assembled by Eurostat.

Slovakia lags far behind Japan (3.4 percent), the United States (2.6 percent), and the European Union leaders in R&D spending such as Sweden (3.75 percent) and Finland (3.73 percent). Slovakia is also behind the other three Visegrad Group (V4) countries with the Czech Republic spending 1.47 percent on R&D, Hungary reaching 1percent and Poland standing at 0.61 percent in 2008. Even more alarming is the fact that spending on public education follows roughly the same path as R&D spending, with Slovakia sitting at the tail end of V4 countries and lagging far behind the EU average.

Additionally, the share of private sector R&D funding in Slovakia has taken the opposite direction to the target set in Barcelona as it has steadily decreased from 53.6 percent of R&D spending in 2002 to just 34.7 percent in 2008. This indicates a low R&D capability on the part of Slovak enterprises and a persistent lack of larger scale, higher value added foreign investments in the country.

Even though successive Slovak governments have not intensively supported R&D within the country, it is clear that human potential and innovative talent exists across Slovakia – indeed the success stories recorded so far demonstrate that in Slovakia there can be “a big bang for your buck”. n

Pavol Kopečný is the general manager of ECENTER and Tomáš Vyšný is the Project Manger of ECENTER.

More information about Slovak business environment you can find in our Investment Advisory Guide.

Author: Pavol Kopečný and Tomáš Vyšný

(source: Global Competitivness Report 2010-2011, World Economic Forum)

(source: Global Competitivness Report 2010-2011, World Economic Forum)