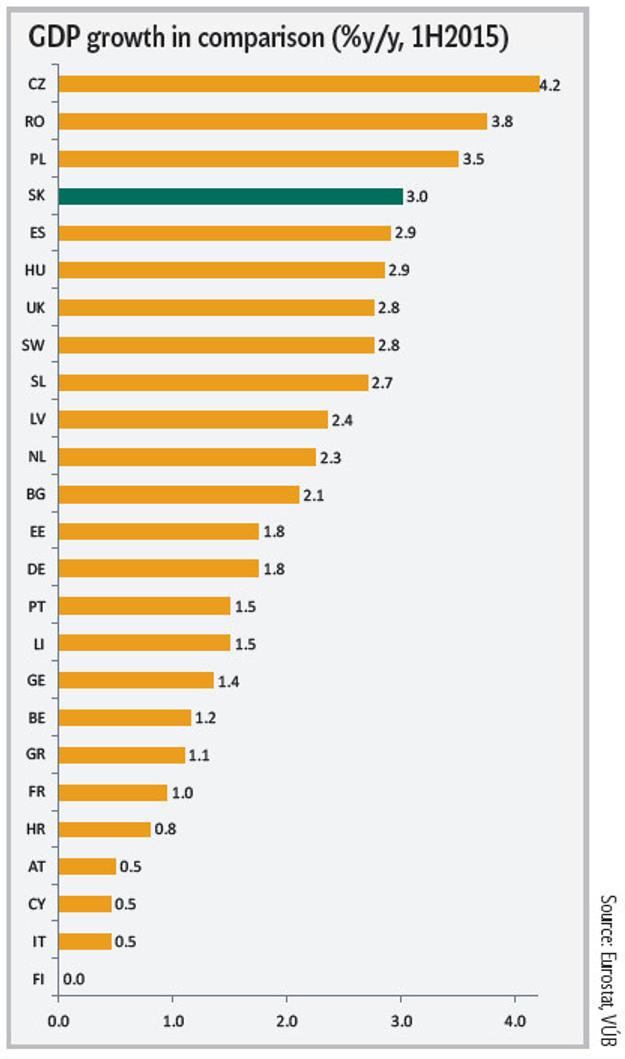

GDP growth picked up from 2.4 percent last year to over 3 percent by mid-2015, the fastest from among all eurozone member countries.

More information about the Slovak business environment

Please see our Investment Advisory Guide.

This year’s edition was published also thanks to cooperation with the Investment Support Association (ISA). The general partner of the guide was the law firm Noerr.

Job growth at the same time doubled its pace of last year to over 2.5 percent, thus allowing employment to finally recover back to the pre-2008 crisis level. The unemployment rate meanwhile dropped to 11.2 percent, 2 percentage points below the level of a year earlier and the lowest in the past seven years.

Investment dynamics distorted by EU funds

The caveat, however, is that this year’s acceleration in GDP and job creation owes to a large extent to a temporary, EU-funded surge in investment spending rather than a sustainable upshift of economic gears. Indeed, driven by last minute efforts to utilise EU funds from the 2007-2013 programming period available only until the end of 2015, public investment in the second quarter shot up in Slovakia to unprecedented 80 percent year-on-year growth, which itself contributed nearly half of the GDP gain of 3.2 percent. As drawing on EU funds next year returns back to or even below the previous levels, one would expect that the associated downward correction in public investment becomes a drag on growth in 2016. Note that intensive investment activity oiled by EU funds boosts also Slovakia’s neighbouring economies, notably the Czech Republic and Poland, which currently rank in GDP growth even above Slovakia. And following 2015’s boom, payback in public investment next year looks likely in these countries as well.

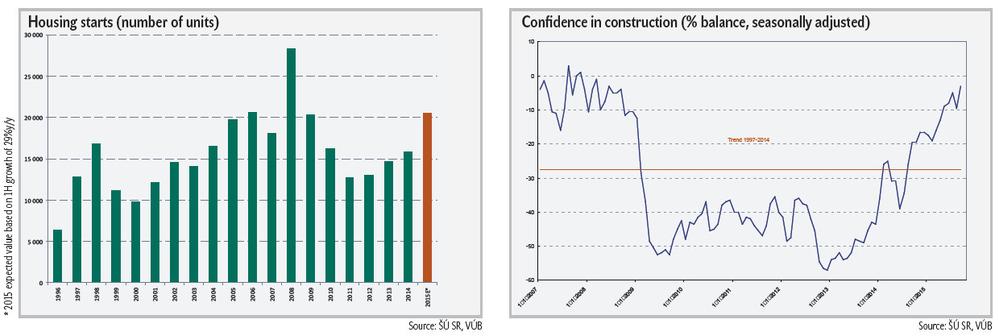

Construction is supported by recovering housing market

Private firms investments meanwhile are likely to continue to gradually recover, for example in the manufacturing sector, which is reporting rising capacity utilisation. Recovering to pre-investments in residential property also appears to be nearing pre-crisis levels, as documented in the rise of new housing projects (see the chart). The rise in housing construction and, even more so, the increase in public infrastructure projects have turned around the long-depressed construction sector. Confidence in this sector recovered to pre-crisis levels (see the chart) and its output is currently growing at a rate of around 15 percent year-on-year. Such a growth pace is nonetheless exceptional and as EU-funded infrastructure projects next year return closer to average levels of the previous years, expansion in this sector is likely to slow down.

Automotive sector weighed down by uncertainty over VW

In the automotive industry, the dominant Slovak manufacturing sector, two recent pieces of news will shape next year. First, there are potentially huge positive implications stemming from the intended arrival of Land Rover Jaguar in Slovakia. If this investment, potentially the largest over the past decade, becomes reality, one would expect private investment next year and automotive production later on to receive a significant boost. The second piece of news, however, could pour cold water on automotive expansion. Indeed, the recent emission scandal of Volkswagen will probably lead to a freeze of new investment by Europe’s dominant carmaker, which has a significant production unit in Slovakia.

Considering all these fluid developments, our best guess is that incremental investments by the private sector next year will probably only match the inevitable decline in public investment. The combined public and private investment activity would thus repeat the level of 2015 and contribute nil to GDP growth. Note, though, that this would still be a smoother outcome than in 2011/2012, when investment went through a boom-and-bust mini-cycle driven by overly generous government subsidies to quickly build photovoltaic energy capacity in the country.

Consumption should remain supportive of GDP growth

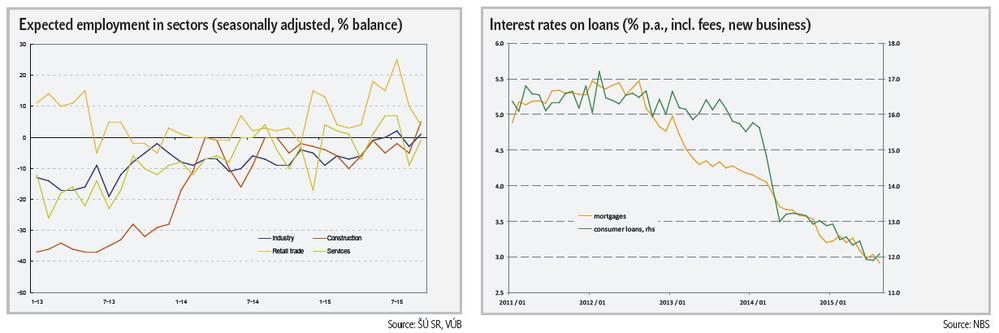

Relative to the volatile investment development, consumption will likely maintain its current steady uptrend and contribute to the overall GDP growth probably as much as it did this year and last. Consumption should benefit from continuous improvement in the labour market and consumer confidence. Judging by business surveys, hiring intentions of local employers are the most positive in recent history (see the chart). The number of jobs in the economy will thus continue to grow, however, probably less than in 2014-2015 when temporary measures boosted employment in the public sector.

Consumption, nevertheless, will be boosted by fiscal electioneering ahead of the parliamentary elections in the spring 2016, that will bring about, for example, an increase in the minimum wage and a decline in VAT on basic foodstuffs. Real incomes of households meanwhile will continue to be boosted by declining costs of energy, which will keep consumer price inflation close to zero. Households, moreover, will also continue to benefit from declining interest rates, which allow them to refinance their mortgages and consumer loans at lower costs, leaving them thus with more income to spend and save. Hitherto, households have been rather cautious and, while borrowing and spending more they also saved more. Indeed, their saving rate in 2015 increased to the highest level in 15 years even as interest rates declined to historic lows. As the labour market tightens and households gain more confidence in their job safety, it is likely that propensity to consume will also increase.

Global uncertainty pushes growth outlook down

Foreign demand, the long-time key growth driver of the Slovak economy has recently moderated as global economy and trade flows slowed. Contribution of net foreign trade to GDP growth has even turned negative as, growth-wise, imports, fuelled by rising investment activity, overtook exports. Next year, the dynamics of the two should switch on payback in public investment activity and related imports. Exports, nonetheless, will also decelerate as the global economy moderates further due to an ongoing slowdown of emerging countries, especially China. The magnitude of this slowdown, moreover, is subject to increasing pessimism against the downward revisions of global economic growth, lately, for example, by the IMF.

Importantly, for the time being at least, the outlook for Germany, Slovakia’s key trading partner, remains relatively positive. Growth in the eurozone overall should be supported by a loose fiscal stance, improvement in financial conditions, and lower oil prices. Our colleagues in the Intesa Sanpaolo research project predict for the eurozone in 2016 growth of 1.7 percent, up from 1.5 percent expected this year. As things stand, hence, our baseline scenario counts on small, yet positive contribution of net exports to Slovak real GDP growth in 2016 (see chart for quantitative details). Clearly though, uncertainty is very high and we may have to revisit this assumption should the global economy falter even more.

By Zdenko Štefanides, chief economist at VÚB

(source: Sme)

(source: Sme)