At the start of 2025, Slovak households began to feel the full impact of government austerity measures aimed at consolidating public finances. A hike in value-added tax (VAT) and a cut to the child tax bonus have pushed up inflation, further eroding household purchasing power.

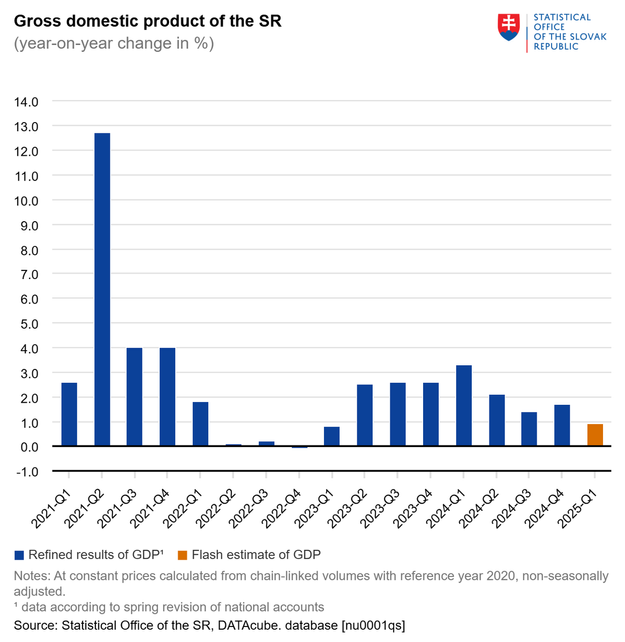

The anticipated tax increases prompted many families to stock up on goods late last year, leading to a sharp drop in spending this spring. This decline in consumption has emerged as a major drag on Slovakia’s economy, which posted its slowest year-on-year quarterly growth in two years.

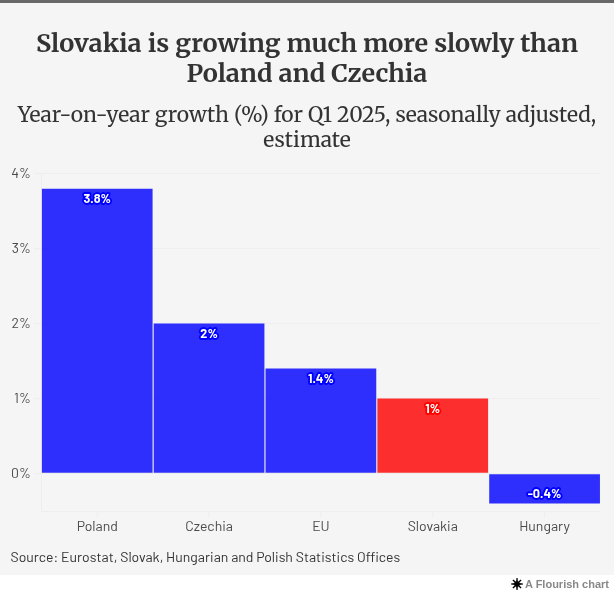

According to the Statistics Office, Slovakia’s GDP growth in the first quarter of 2025 lagged behind that of neighbouring Czechia and Poland. Analysts say fiscal tightening was a key factor behind the underperformance.

“Fiscal consolidation and its structure likely dampened economic growth at the start of the year and widened Slovakia’s gap with Poland and Czechia,” said UniCredit Bank analyst Ľubomír Koršňák, as quoted by Denník N.

Even an uptick in car exports to the US, ahead of possible import tariffs, failed to offset the domestic slowdown. The strongest impact was felt in durable goods – car registrations, for instance, dropped by 13 percent year-on-year in Q1.

Despite the downturn, record-low unemployment – coupled with more than 100,000 open job vacancies – helped cushion the blow. Households still account for the lion’s share of domestic economic activity.

Slovakia’s post-Covid rebound had outpaced its regional peers, but that head start may now be fading, according to Denník N. The country’s economy is currently 8 percent larger than it was before the pandemic, compared with 3 percent in Czechia and just over 5 percent in Hungary. Poland leads the region, having grown more than 14 percent since 2020.

Looking ahead, economists say the outlook will hinge on global trade developments. With the US and EU facing off over tariffs – particularly in the automotive sector – Slovakia’s export-heavy economy remains exposed. Any escalation could cost thousands of jobs.

Meanwhile, consumption is expected to remain muted as consolidation measures continue to feed into prices. Analysts say growth may regain momentum later this year, supported by falling interest rates from the European Central Bank and investment linked to the EU’s recovery fund. However, whether the Slovak government can spend the available EU funds efficiently remains an open question.