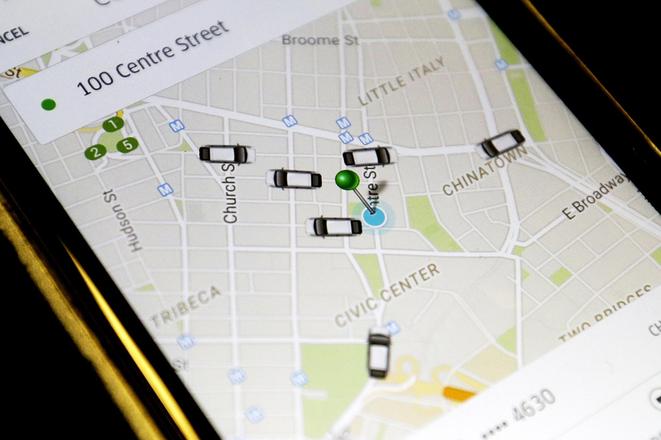

Digital platforms like Uber, Airbnb and booking.com have resulted in new challenges in taxation. This is because the so-far tax approach was based on physical presence, i.e. the business entity was physically present in the country where it did its business and it was subsequently taxed. This is not true anymore. As a consequence, digital platforms do not pay taxes in the countries in which they do business but shift their profits to lower-tax locations. So new models on how to tax these companies are being sought. While Slovakia has come up with its own solution, the European Commission has been already working on new legislation addressing taxation in a sharing economy.

“It is like having road traffic rules for bicycles while we already have flying cars in the streets,” said Ľubica Dumitrescu, tax expert at Deloitte in Slovakia, when describing the existing taxation scheme.

Rules for international taxation are obsolete and lead to base erosion and profit shifting (BEPS). This refers to corporate tax planning strategies artificially shifting profits from higher-tax locations to lower-tax locations and thus eroding the tax-base of the higher-tax locations.

International organisations including the Organisation for Economic Co-operation and Development, G20 as well as the European Commission aim to adapt the current EU tax rules to the digital developments of the 21st century and the different ways of creating profits in the digital world.

The European Commission (EC), which sees that digitalisation provides benefits and opportunities, on March 21 proposed new rules for the taxation of digital activities and digital business models in the EU.

“The amount of profits currently going untaxed is unacceptable,” said Valdis Dombrovskis, Vice-President for the Euro and Social Dialogue at the European Commission as cited in the press release. “We need to urgently bring our tax rules into the 21st century by putting in place a new comprehensive and future-proof solution.”

The EC arrived with two distinct legislative proposals. The first initiative aims to reform corporate tax rules so that profits are registered and taxed where businesses have significant interaction with users through digital channels.

(source: AP/TASR)

(source: AP/TASR)