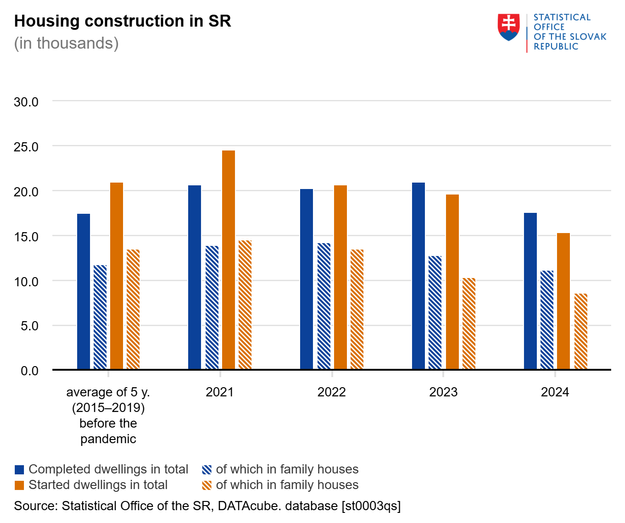

Slovakia’s housing sector is experiencing its sharpest slowdown in years, with the number of newly completed homes falling to its lowest level since 2017, according to fresh data from the Statistics Office. Just over 17,600 homes were finished in 2024, a decline of nearly 16 percent compared to the previous year.

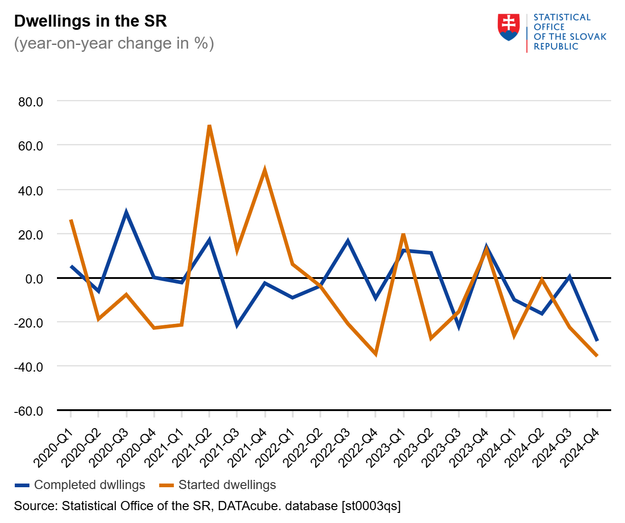

The downturn was particularly stark in the final quarter, when only 4,900 homes were completed – a nearly 29 percent year-on-year drop and the lowest quarterly figure in 13 years. The pace of new construction also faltered, with just 3,600 units breaking ground in the last three months of the year, a third fewer than in 2023.

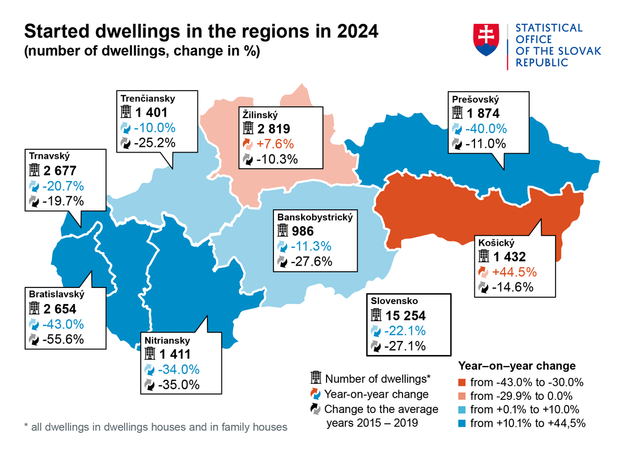

While much of the country struggled, Košice bucked the trend. The region in eastern Slovakia saw a 50 percent surge in completed homes in late 2024, providing a much-needed boost to the local housing market. Košice and its surroundings need fresh development, and property prices are expected to rise, real estate agents in the region told Hospodárske noviny.

Construction declines across Slovakia

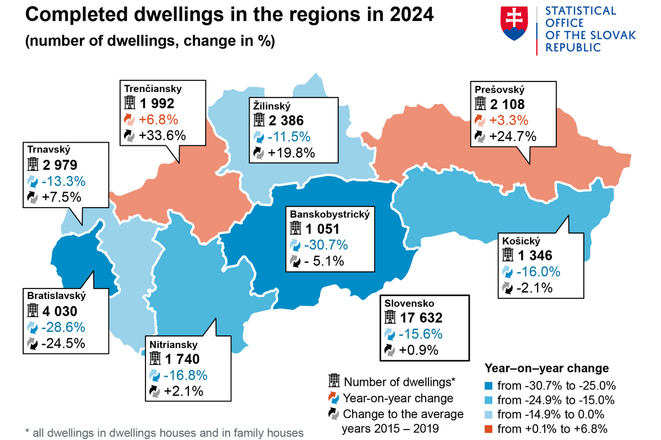

New housing projects slowed in seven of Slovakia’s eight regions, with the sharpest declines recorded in Bratislava and Banská Bystrica, where completions fell by more than a quarter. The capital remained the focal point for new development, but construction lagged significantly behind previous years. Only Trenčín and Prešov saw modest increases, with completions rising by nearly 7 and 3 percent, respectively.

The slowdown has also affected future supply. Just 15,300 new homes were started in 2024, a 22 percent drop from the previous year. By year-end, 77,200 units remained under construction – nearly 3 percent fewer than at the end of 2023.

New housing supply lags pre-pandemic levels

The decline in housing activity extends beyond completed projects. The number of new developments has fallen sharply, with figures in September 2024 standing 40 percent below the five-year pandemic average. While Slovakia had 78,000 homes under construction at the end of the third quarter, this was nearly 3 percent lower than a year earlier and only 6 percent above pre-pandemic levels.

Regional disparities are becoming more pronounced. In the third quarter, Slovakia completed 4,251 new homes – just 0.4 percent higher than the previous year. Trnava led the country in completions, with a 56 percent year-on-year increase, while Trenčín and Prešov recorded smaller gains. However, five of Slovakia’s eight regions saw declines, with Bratislava and Košice suffering the most significant drops.

With economic uncertainty persisting, the question now is whether 2025 will bring a recovery – or further stagnation for Slovakia’s housing market.

(source: Statistics Office)

(source: Statistics Office)

(source: Statistics Office)

(source: Statistics Office)

(source: Statistics Office)

(source: Statistics Office)

(source: Statistics Office)

(source: Statistics Office)