Even though it is not in the spotlight of the media and state support as, for example, the automotive industry, its importance cannot be overlooked either thanks to its contribution to Slovakia’s economy as well as the fact that nowadays nobody can imagine the world without ICT technologies. And while Slovakia’s ICT companies fare well internationally, they would still like to see better conditions in Slovakia for doing business and more attention also from the state.

More information about the Slovak business environment

Please see our Investment Advisory Guide.

This year’s edition was published also thanks to cooperation with the Investment Support Association (ISA). The general partner of the guide was the law firm Noerr.

“Only some few realise the current contribution of our sector not only for the economy of this country, as shown by the study that INESS Consult prepared for us, but much more important is its contribution for the future of the country,” Mário Lelovský, the head of the IT Association of Slovakia (ITAS), told The Slovak Spectator. “Already now ICT is a sector that without any swings maintains a stable increase of the workforce as well as of wages that are the highest of all economy’s sectors. Today we actually cannot imagine work not requiring knowledge of ICT skills.”

When summing up benefits the ICT sector brings, Lelovský pointed out that while the ICT sector accounts for 2.3 percent of the employment, its share of GDP is double, 4.6 percent.

“Our sector pays regularly several times higher corporate income taxes than, for example, the automotive sector, when employing less people,” said Lelovský. “Thus it is a sector with a high, but also declared, added value. This accounts for as much as 8.6 percent of the total taxes of business entities.”

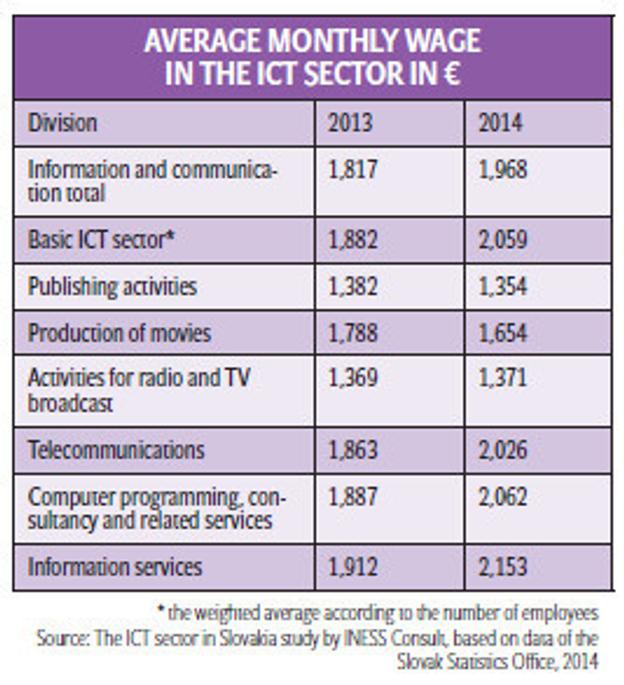

The ICT sector also sports the highest average wage and actually does not know the word unemployment. Companies belonging to this sector rank among the biggest investors and employers.

“The pressure of competition as well as constant development of new technologies forces these companies to invest and innovate which has a nation-wide impact in the form of new and better services or reduction of prices,” Martin Kóňa, spokesman of the Ministry of Transport, Construction and Regional Development, told The Slovak Spectator. “Electronic communications are an inevitable part and precondition for a problem-free operation of remaining sectors of the economy. They contribute in a significant way to the development of innovations in other sectors.”

The ministry sees their main contributions in the possibility of communication, transfer of large volumes of data and reduction of costs.

“They create preconditions for new approaches to employment of people like remote work or working from home and their education,” said Kóňa. “They create conditions for securing the contact of selected groups of the population, like seniors, long-term ill people or people living in remote regions.”

ICT sector in Slovakia

The ICT sector accounts for 2.3 percent of the employment in Slovakia or 62,000 people while its share of GDP is 4.6 percent, based on the analysis of INESS Consult published in late 2015.

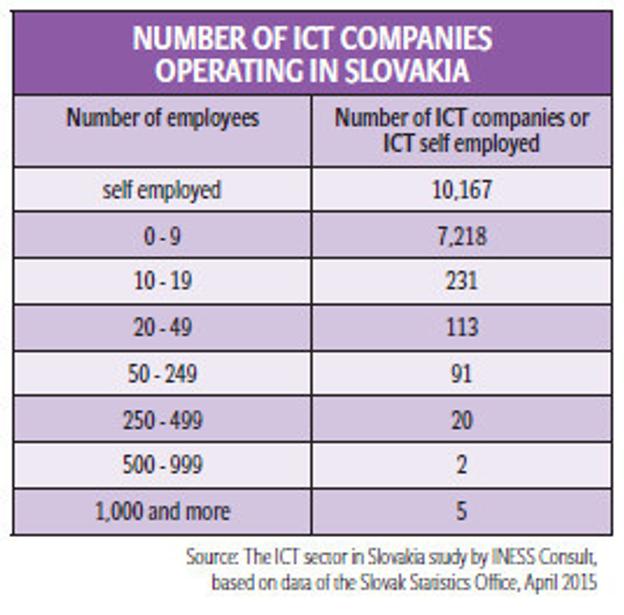

The analysis cites two estimates of those working in the ICT sector in Slovakia. The first one is based on the labour force sample survey while it estimates that 62,000 people worked in the ICT sector during the first quarter of 2015, an increase from 56,200 in 2014. Out of this, employees made up 52,400 people, an increase from 44,500 in 2014. The second estimate is based on data of the Slovak Statistics Office about the registered number of employees. Here the average number of employees in the ICT sector was 32,832 in 2014, up by 18 people compared with 2013, but these figures do not include companies with up to 19 employees. The office registered a moderate decrease of the self-employed, 10,073 as of the end of 2014.

The biggest employers are Slovak Telekom with the average number of workers in 2014 based on the Top 200 collected by the Trend economic weekly, 3,649 people, followed by T-Systems Slovakia (3,118) and Hewlett-Packard Slovakia (1,744). Other big employers are Asseco Central Europe, Orange Slovensko, Accenture Technology Solutions, IBM Slovensko, Eset, Ness Slovensko and Telefónica Slovakia (now O2).

This shows that the 10 biggest Slovak ICT companies in Slovakia employ more than one quarter of employees in this sector. The other 19,000 employees work in ICT companies with 20 or more employees and the remaining in ICT companies with up to 19 employees.

“The ICT sector is specific with a large number of small companies with one to three employees and a large number of self-employed on one side and some dominant companies on the other side,” the analysis reads.

The ICT sector has the highest average wage out of all monitored sectors, based on data of the Slovak Statistics Office. The wages increased in this sector from €1,817 in 2013 to €1,968 in 2014 or 8.3 percent. This growth was faster than the growth of the average wage in the Slovak economy.

High wages mean also high compulsory health and social insurance contributions as well as paid income taxes. In 2004 businesses in the ICT paid in corporate income taxes €167.4 million or 8.6 percent of the total corporate tax paid in 2014, based on data of the Financial Administration. For comparison, the sector or production of motor vehicles paid corporate tax of €179 million and the industrial production €448 million.

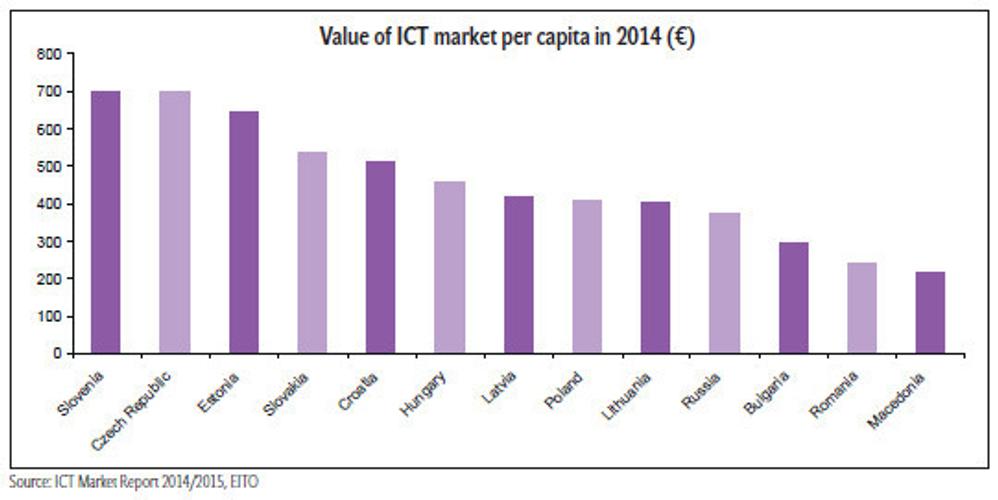

“The ICT sector was one of the key sectors of the economic development of Slovakia,” the analysis reads. “Even though it continues to be one of the two driving forces of the Slovakia’s economy, the ongoing crisis and the decrease of the competitiveness of Slovakia have been leaving traces on it.”

Authors of the analysis compare the ICT boom with the automotive industry, which grew significantly in Slovakia during the last decade and is the most important industrial sector in Slovakia.

“Maybe less visible, but the ICT industry developed more systematically in Slovakia during this period of time,” the analysis reads. “And this happened not only in the form of the arrival of large foreign players but also the growth of local companies.”

After the financial and economic crisis burst out in 2008, the development in the two sectors differed. While the automotive sector registered a fast decline and afterwards a fast increase again, the strongest sub-sector of ICT, i.e. production of monitors and TVs, maintained moderate growth until 2010 and afterwards it began declining.

“But this decline is balanced by the growth of other groups of ICT products, especially telephones,” the study reads. “Though also this growth segment slowed down in 2014 and the volume of export of television sets decreased by almost 5 percent.”

The ICT sector remains to be one of the two most important export sectors of Slovakia. Monitors and TV screens are still the most significant items, but the growth of other ICT products joins them gradually, especially telephones. Analysts predict growth for the global ICT sector, making it one of the possible natural cures for the crisis.

“Already in the past the ICT sector was for some Asian countries a driving force for overcoming the economic crisis,” the analysis reads. “Similarly Estonia presents a successful ICT policy on European ground.”

State support of investment

Investment stimulus is a popular instrument used by the Slovak government and the aggregate stimuli agreed upon by the government between 2002 and 2014 amounted to €1.544 billion. Support went to 127 entities for 151 projects, based on data of the Economy Ministry. From the viewpoint of the sectors, the automotive sector received €789 million or 51.1 percent. The investment assistance provided to carmakers only accounted for €413.4 million, INESS Consult’s analysis reads. On the other hand, the ICT sector received investment stimuli approved for €33.69 million or 2.17 percent between 2002 and 2014.

The share of state assistance on total investments in the ICT sector is 28.2 percent while in the automotive sector it is 17.2 percent.

INESS Consult has calculated the return of investment in the automotive sector at roughly 4.18 years, yet in the case of the ICT sector it is significantly less, 0.68 of a year.

“The [available] data indicate that in regard to the ICT sector the return on investment is significantly faster which is linked with a higher average wage in the ICT sector, higher added value and simultaneously lower investment stimuli calculated per one work place compared with the automotive sector,” reads the analysis.

In general, investment incentives are popular with Slovak cabinets while INESS Consult perceives them as interference into the market environment also bringing several negatives. It points out that while tax holidays, a frequent investment form of stimuli granted in Slovakia, are not accompanied by a drop in state expenditures, actually other taxpayers must fill in the gap.

“Thus companies are forced, via higher taxes, to support their competition,” the analysis reads, indicating that such a financial injection enables the receiver of the stimuli, for example, to draw highly qualified employees from other companies and offer them higher wages.

Slovak ICT companies fare well

Slovak firms repeatedly appear in the ranking of the fastest-growing companies while Eset has been continuously there for 13 years.

The latest annual ranking of central Europe’s 50 fastest-growing technology companies that Deloitte published in late October 2015 features five Slovak companies. BSP Applications, engaged in development of user applications and documents administration placed the highest in the ranking prepared based on their five-year revenue growth, fourth with a revenue growth rate of 1,004 percent over the past five years. Visibility online marketing agency achieved the second best position when it placed 17th with the growth rate of 543 percent. It was followed by Pixel Federation developing game apps for mobile phones at the 29th position with 407 percent. CEIT Technical Innovation focusing on R&D of innovative solutions for industry was 31st with 387 percent and the Promiseo online marketing agency was 32nd with 382-percent growth over the last four years.

The performance of Slovakia, which has the same number of companies on the list as the Czech Republic and more than Hungary, has been gradually improving. In 2013, only two companies made it to the list, in 2014 it was three. The exception is Eset, which has been placed in a separate list of companies that are too big to compete with smaller companies of ‘The Big Five’ for 13 consecutive years. Unfortunately, this year no Slovak company placed in the category of Rising Stars.

Development in this kind of enterprise and the success of companies in information technology lead to the question of whether they have the potential to change predominantly production-oriented Slovakia.

“I think that these two sectors don’t compete with each other, quite the opposite as they’re complementary,” Ivan Lužica from Deloitte stated, as quoted by the TASR newswire. “A production company that wants to be competitive must follow and use the newest technologies and distribution channels.”

eGovernment matters

eGovernment does not mean only usage of computer technologies in offices but a change in the general approach of the administration. While in the traditional bureaucratic process an applicant is a kind of ‘postman’, who must prove with documents a change in the reality or an entitlement at each stage to individual office, in the electronised administrative process he should be only at the beginning and the end of the administrative process.

But the electronisation of state and public services in Slovakia is considered to be insufficient and has become also a target of criticism of Slovak President Andrej Kiska, who in his speech at the 14th annual International Congress on Information Technology Use in Public Administration (ITAPA) 2015 held in Bratislava on November 3 said that the digitisation and electronisation of state and public services in Slovakia has not progressed significantly, despite the presence of ambitious projects.

New technologies should make public administration easier and help society to become “really modern”, he added, as quoted by TASR. Kiska criticised the process of carrying out the Operational Programme Informatisation of Society, which Slovakia launched in 2007.

“The Operational Programme had great ambitions and an even greater budget,” the president went on to say. “Today, eight years later, it’s clear that the state has managed to spend almost €900 million. On many occasions the money was spent in a non-transparent manner and many times without any result. Citizens and entrepreneurs are still acting like postal workers [moving to and fro] between offices.”

The ICT sector identifies the biggest shortcomings especially in the sector of eGovernment and public procurement of advanced technologies but also in creation of a quality business environment. This is one of the conclusions of the analysis of INESS Consult, adding that a healthy development of the ICT sector and its systemic utilisation in the state administration in the form of eGovernment can help Slovakia climb upwards in international rankings of competitiveness.

Another factor which is taken into consideration when assessing the competitiveness of the country from the viewpoint of ICT is transparency and openness of public procurements for ICT products and services.

“The low transparency of procurement not only averts new investors and suppliers from entering the Slovak market, but it also hinders the ability of public institutions to profit maximally from possible savings and higher effectiveness of operation that services of the ICT suppliers generate,” the analysis writes.

Challenges for the future

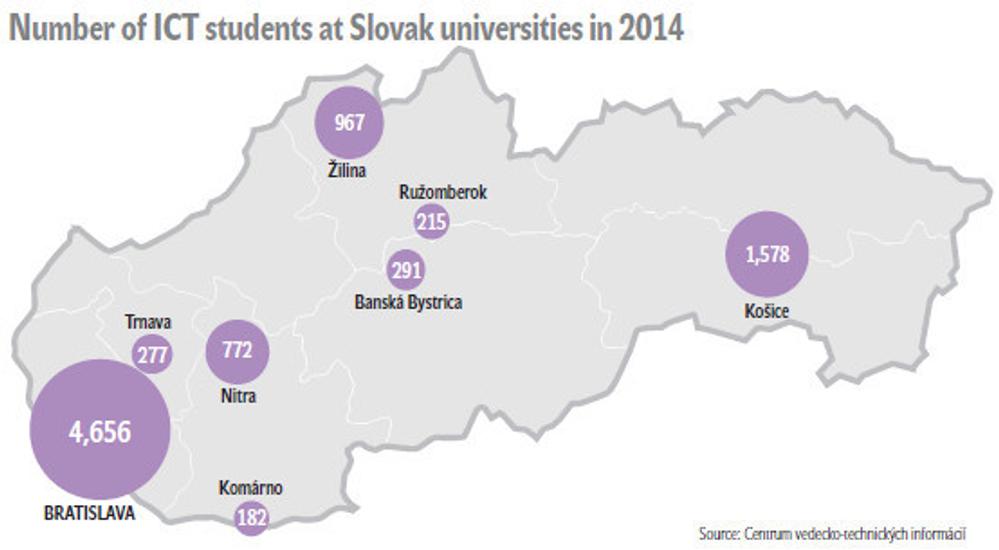

The ICT sector and its successful expansion is especially important for creation of higher value-added jobs and hence appropriate employment opportunities for relevant university-educated graduates, said Vladimír Vaňo, head of CEE research at Sberbank Europe.

“Moreover, it appears to be one of those sectors, which creates also opportunities for Slovaks with relevant experience abroad to ‘repatriate’ back into Slovakia into adequate management positions in the industry dominated by global multi-national players,” Vaňo told The Slovak Spectator. “In the medium term, active cooperation between the business sector and universities will be vitally important to maintain the necessary supply of well-qualified workforce.”

One of the most often mentioned challenges the ICT sector faces is the shortage of labour force.

“The demand for employees in the ICT sector exceeds supply by as much as four times and this is why the ICT sector actually does not know the term unemployment,” Radovan Ďurana from INESS Consult said at the IT Summit held by ITAS on October 1. But a recent survey the ITAS carried out among its members about their labour force needs resulted in revealing that the sector lacks or will lack 10,000 people at least during the next four years, while this number would even increase several times during the coming years also thanks to the arrival of new changes like Industry 4.0, Internet of Things or the Digital Single Market, Lelovský said.

“We see prospects unambiguously in missing people who may not know that we need them and that the ICT sector may mean for them an interesting future,” said Lelovský. “We are also witnessing insufficient attention for the ICT sector from the side of politicians and state leadership.”

(source: Sme)

(source: Sme)